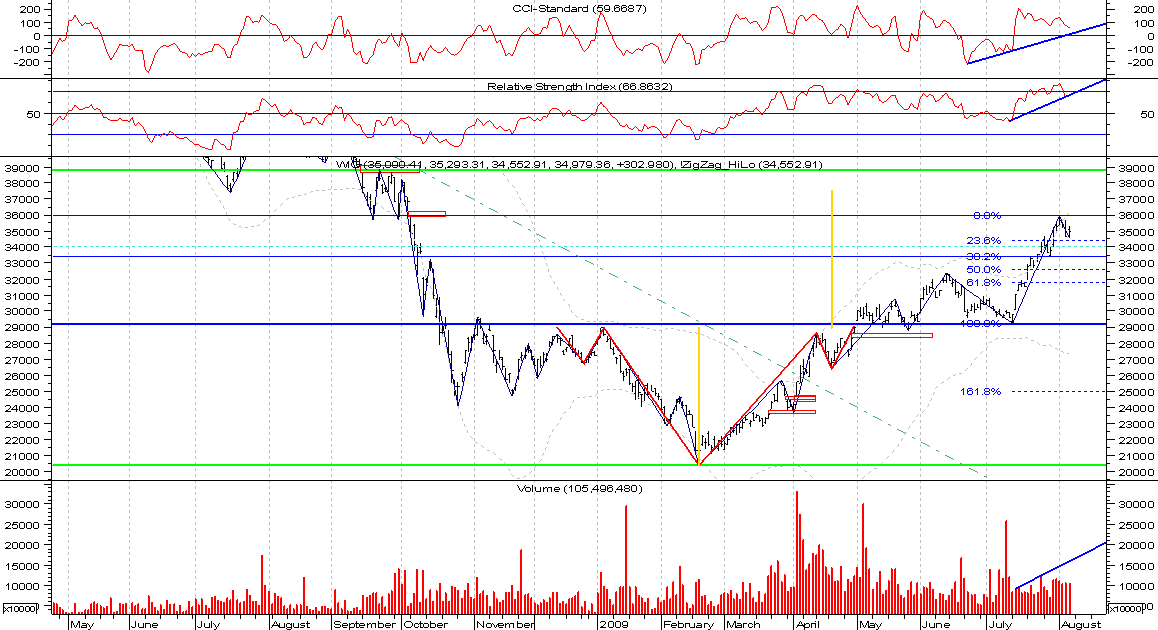

The market almost generated daily sell signal. Neither oscillators nor volume suggest further fall, but most of European markets finished on red. In my opinion we shall be careful now, but until daily trend is broken we want to enter long positions.

China's Shanghai Composite Index fell -6.74% (here).

Sources:

[http://www.marketwatch.com/story/us-stocks-futures-lower-as-china-sinks-again-2009-08-31-9060]

[http://www.bloomberg.com/apps/quote?ticker=SHCOMP%3AIND]