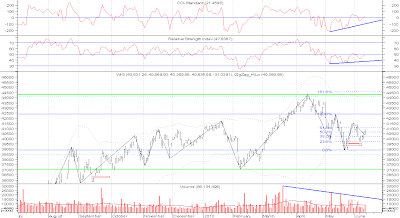

The WIG Index fell -0.31%:

The market fell further generated another daily sell signal. However, we are still in primary uptrend and it's too early to short positions.

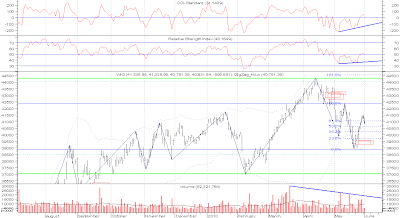

The S&P500 has fallen another -1.01%:

I would say we are still in error margin (above psychological level of 1000), but situation in US does not look good.

There is nice analysis of US markets (here).

Sources:

[http://www.ritholtz.com/blog/2010/06/major-indices-looking-ugly-billy-ray/]

20090415

15 years ago