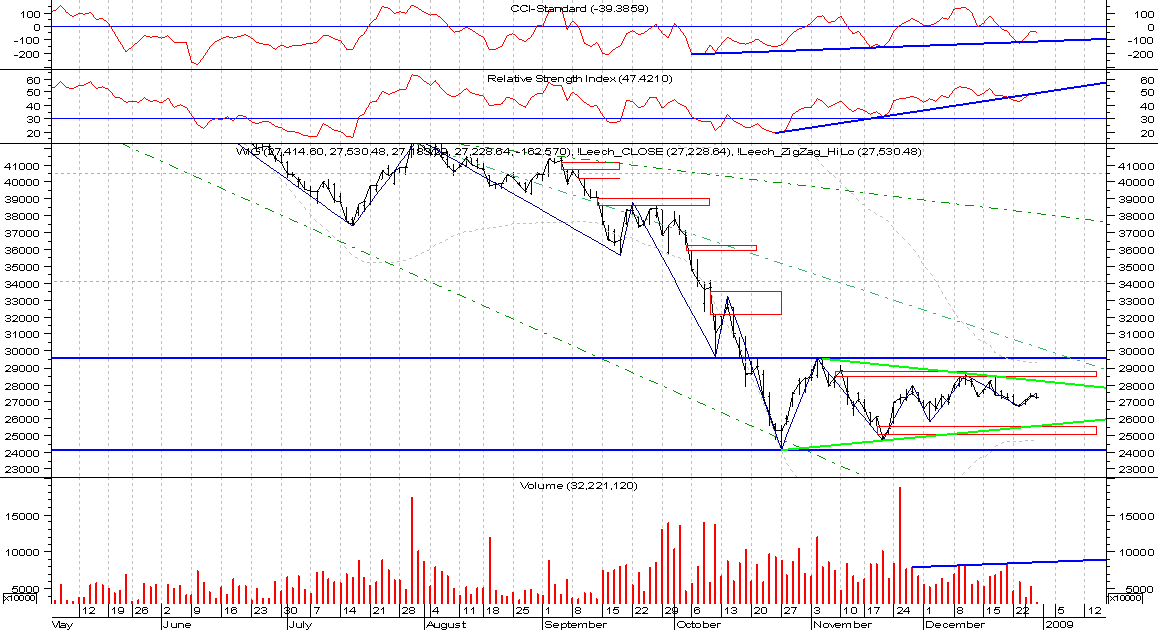

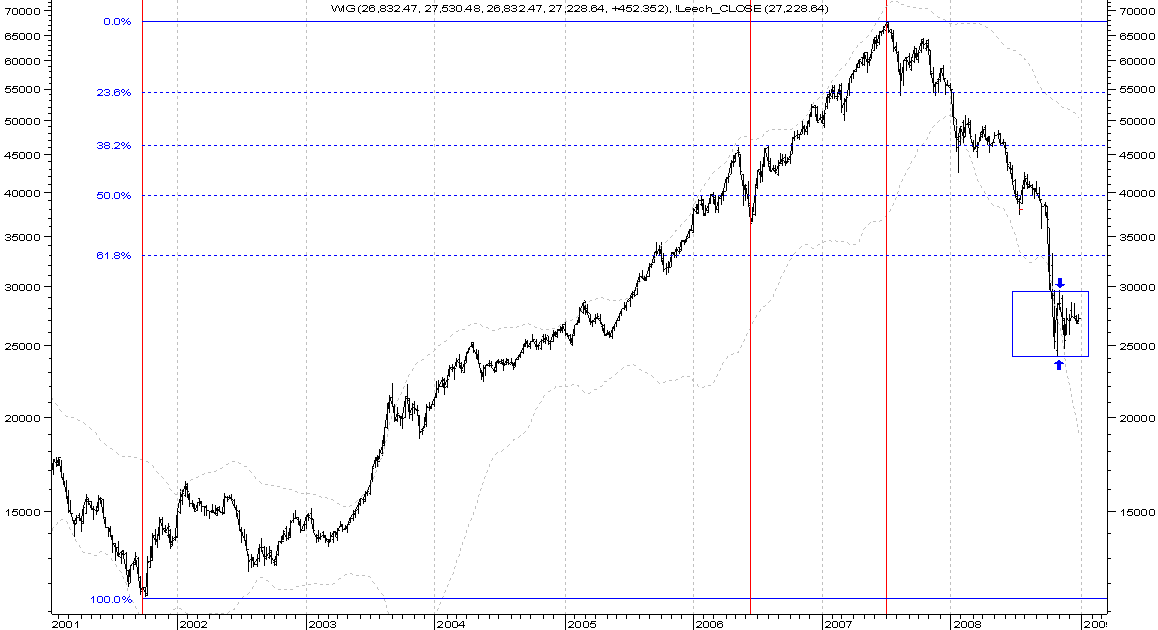

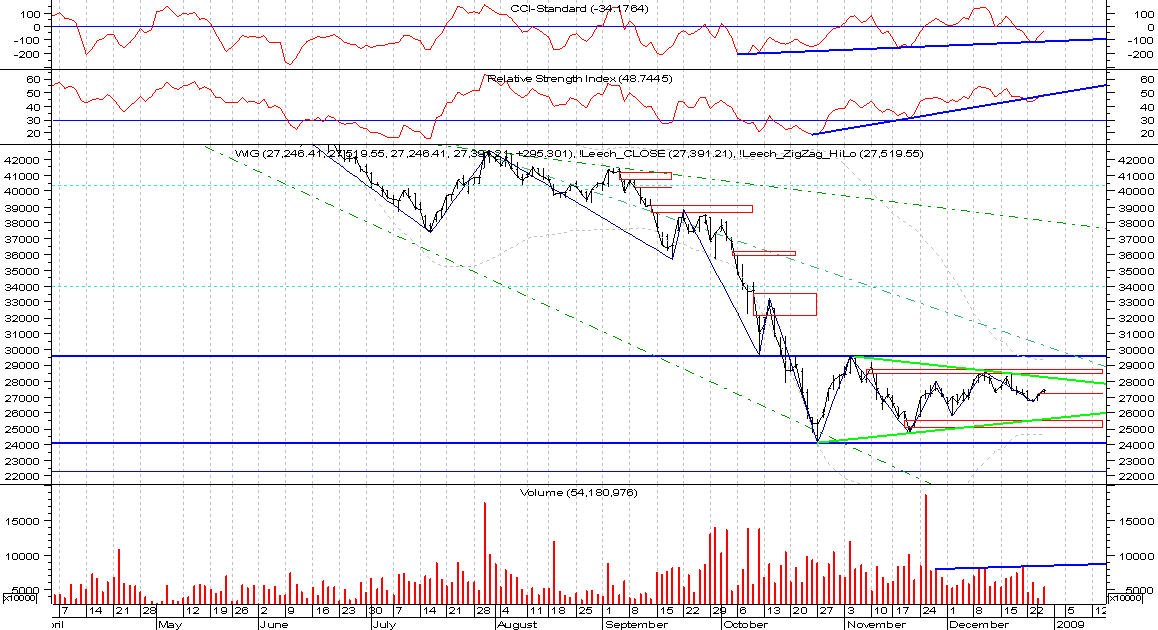

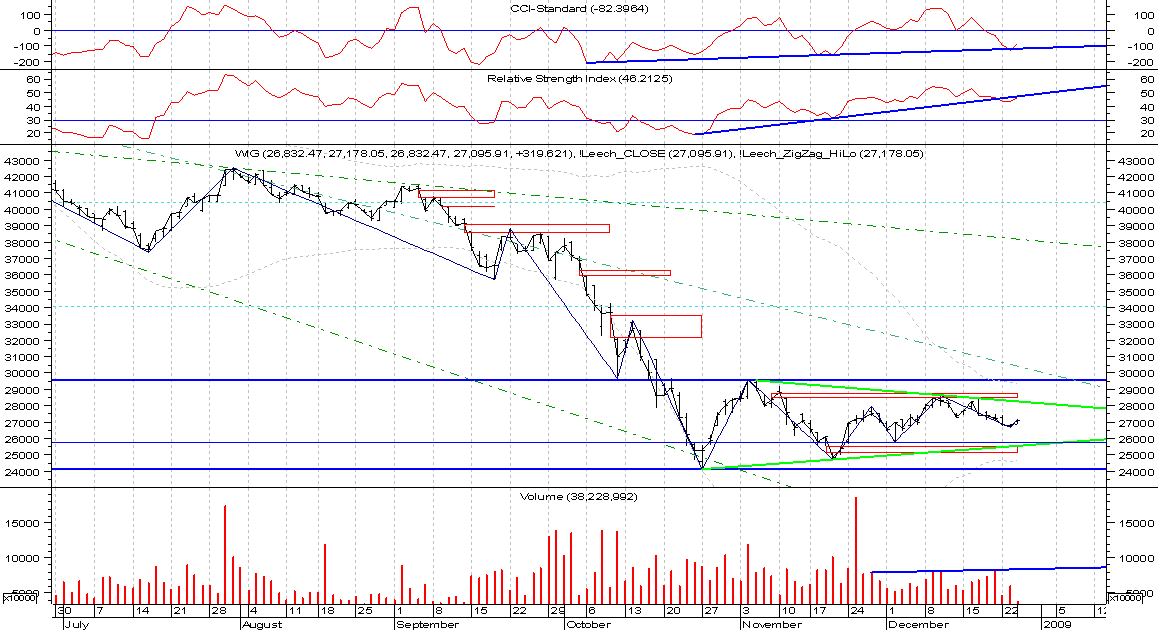

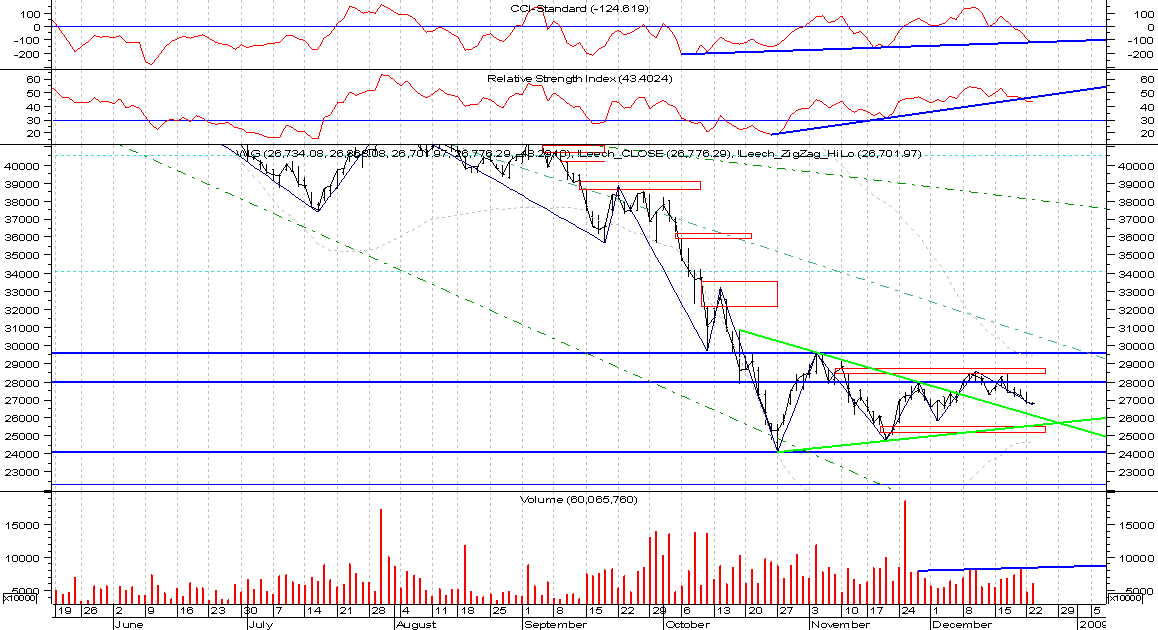

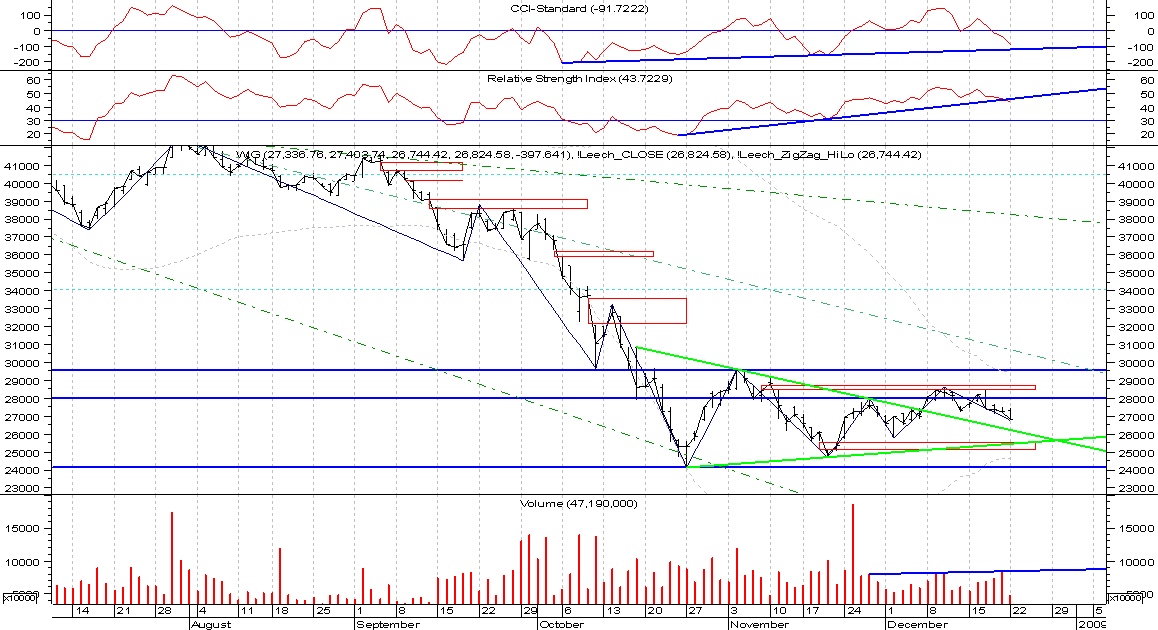

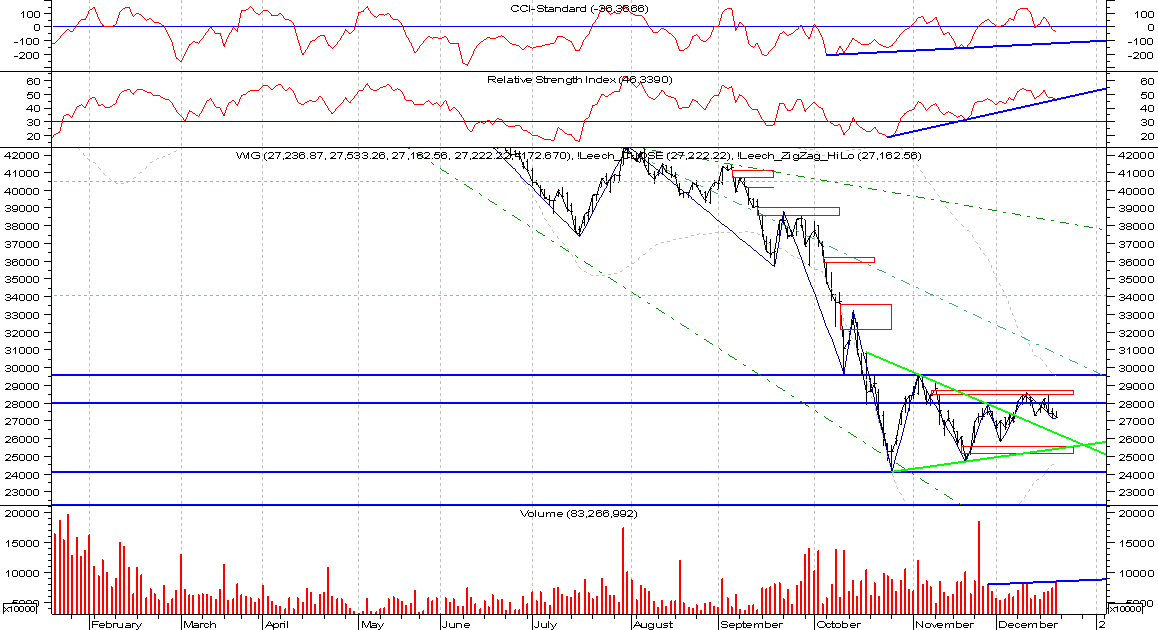

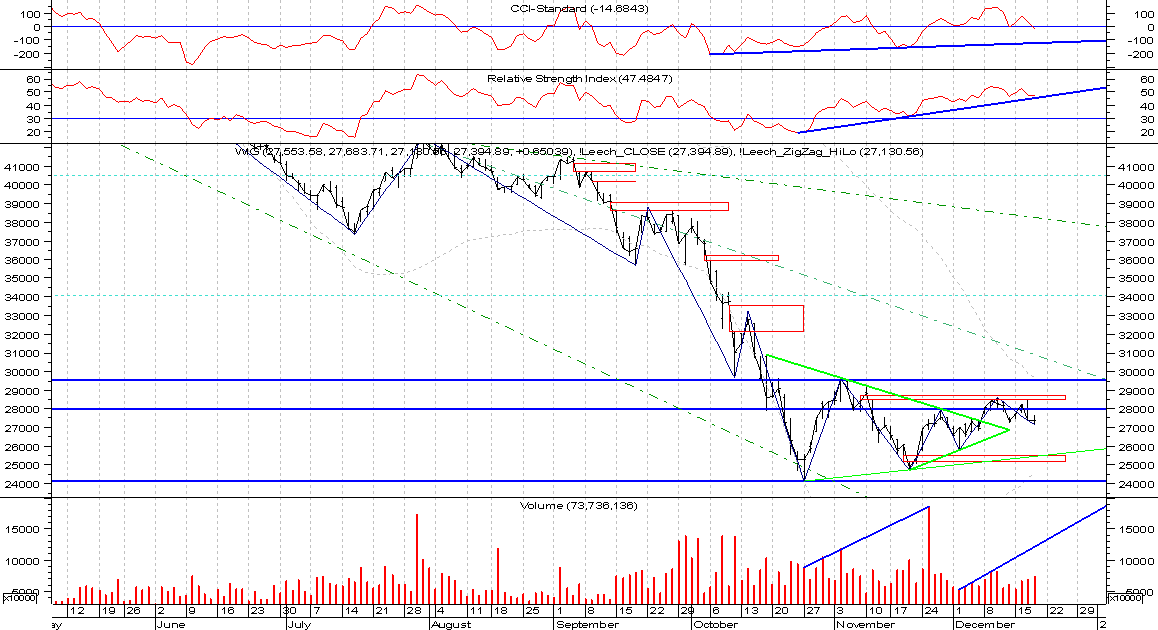

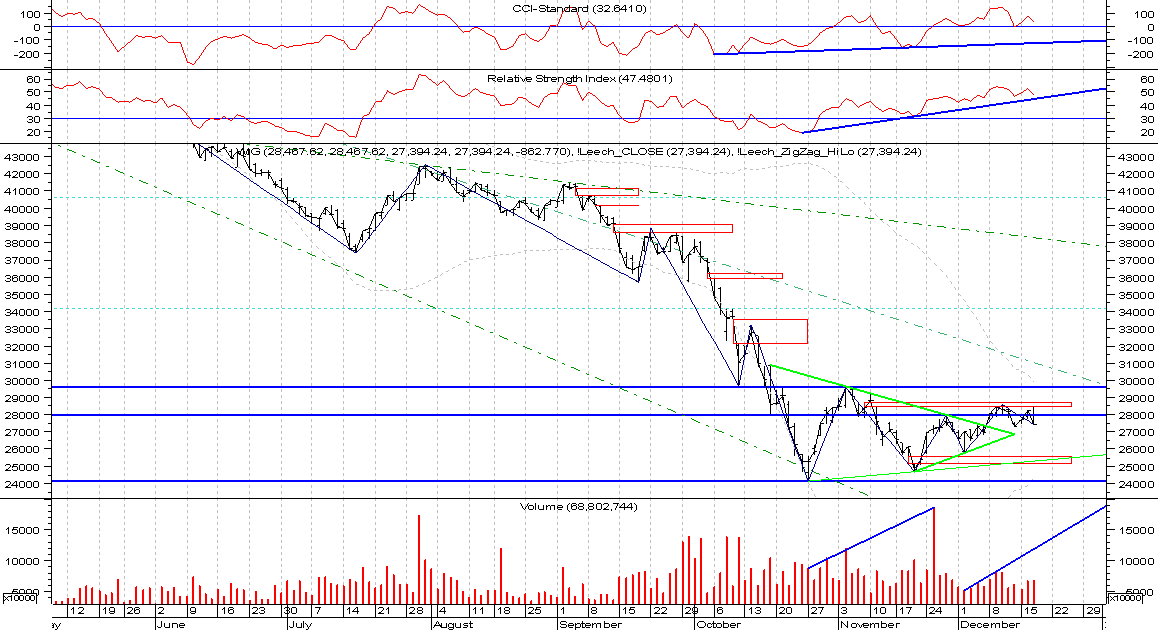

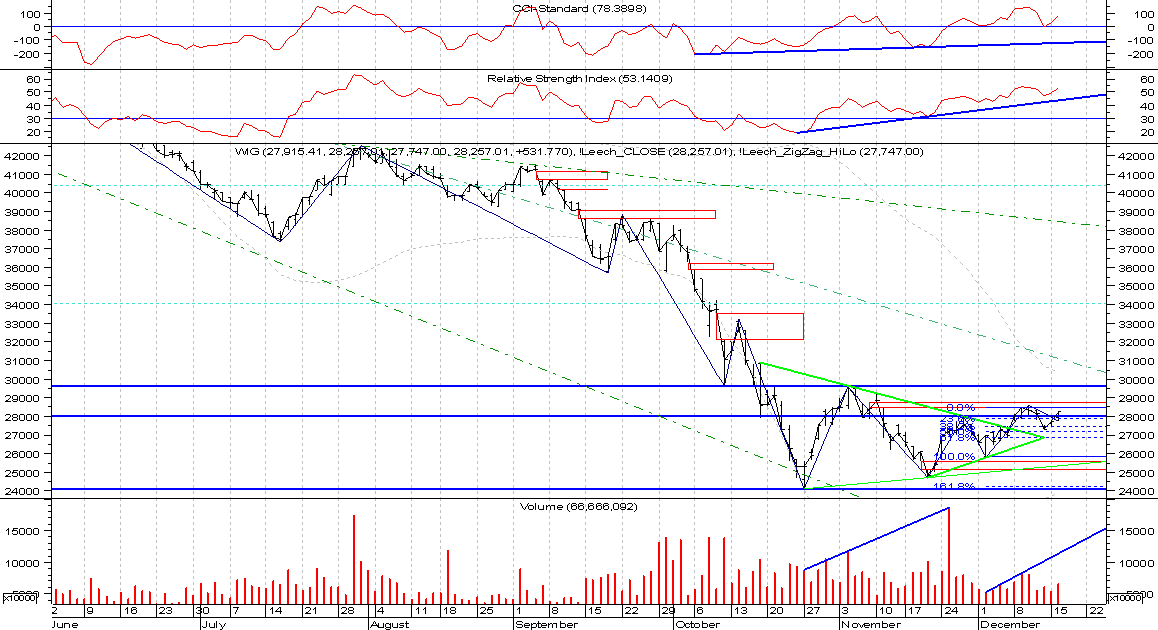

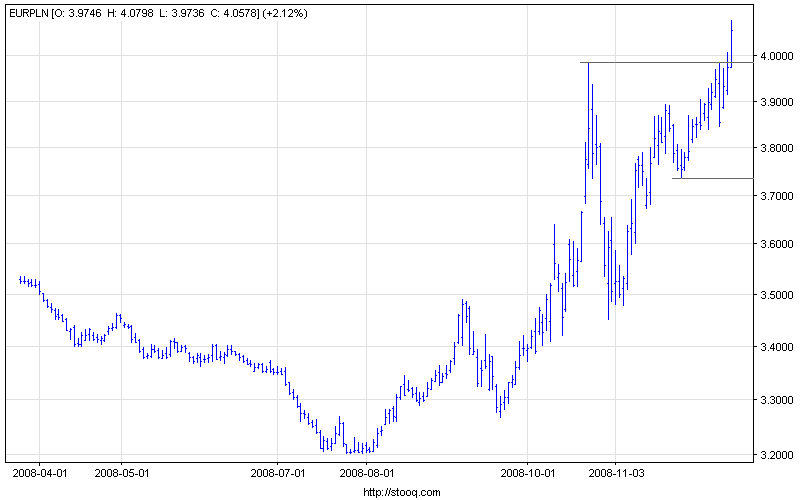

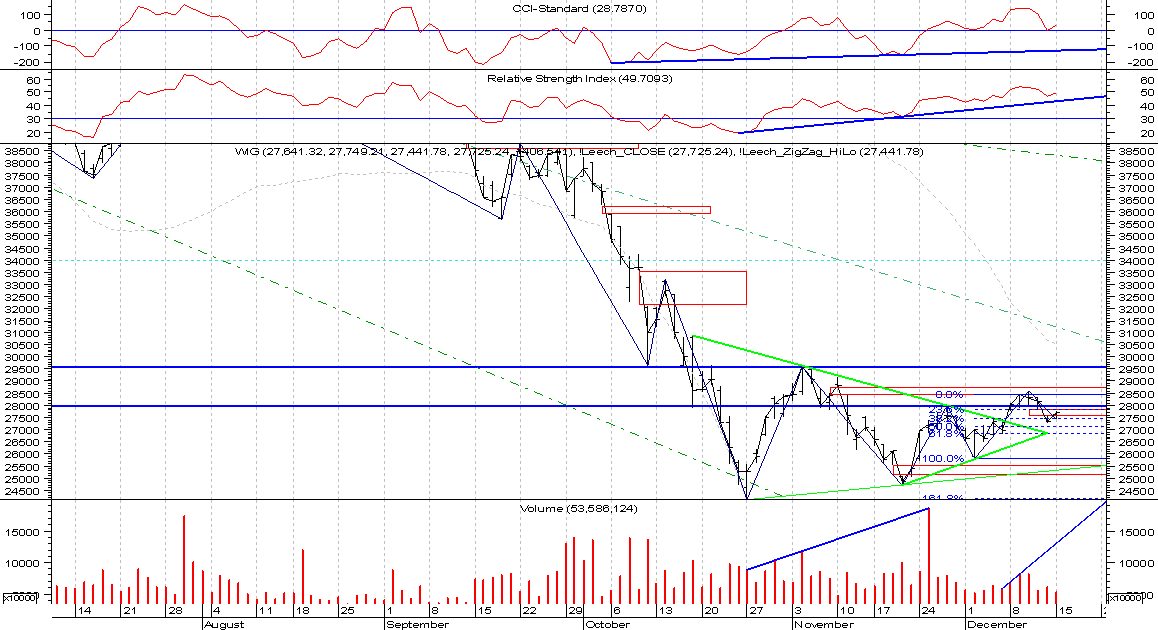

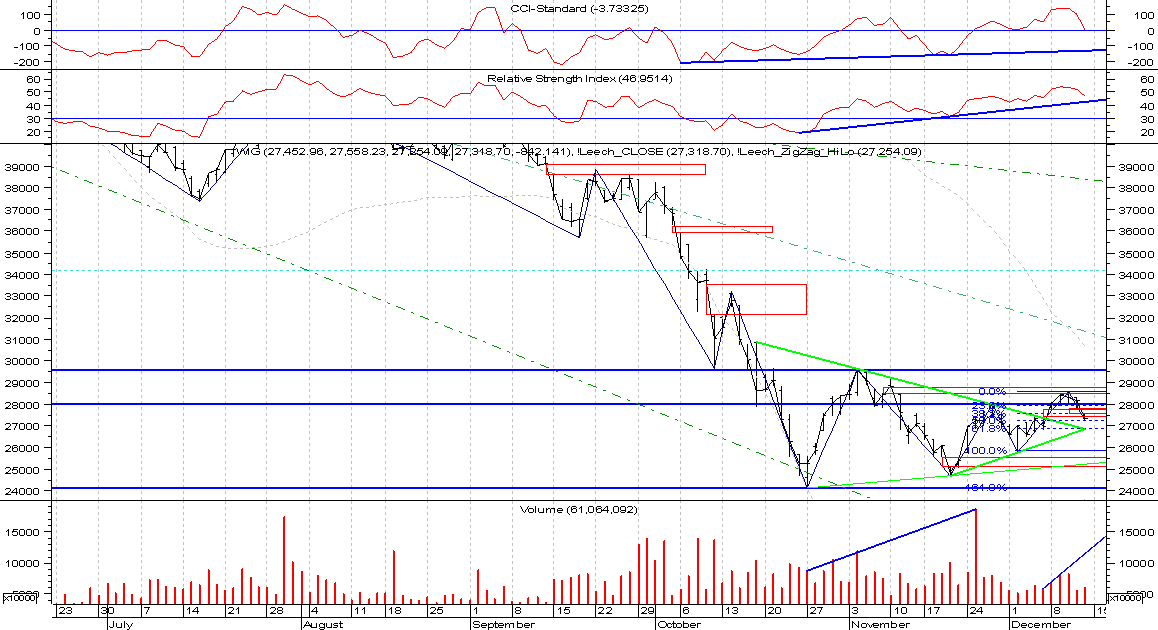

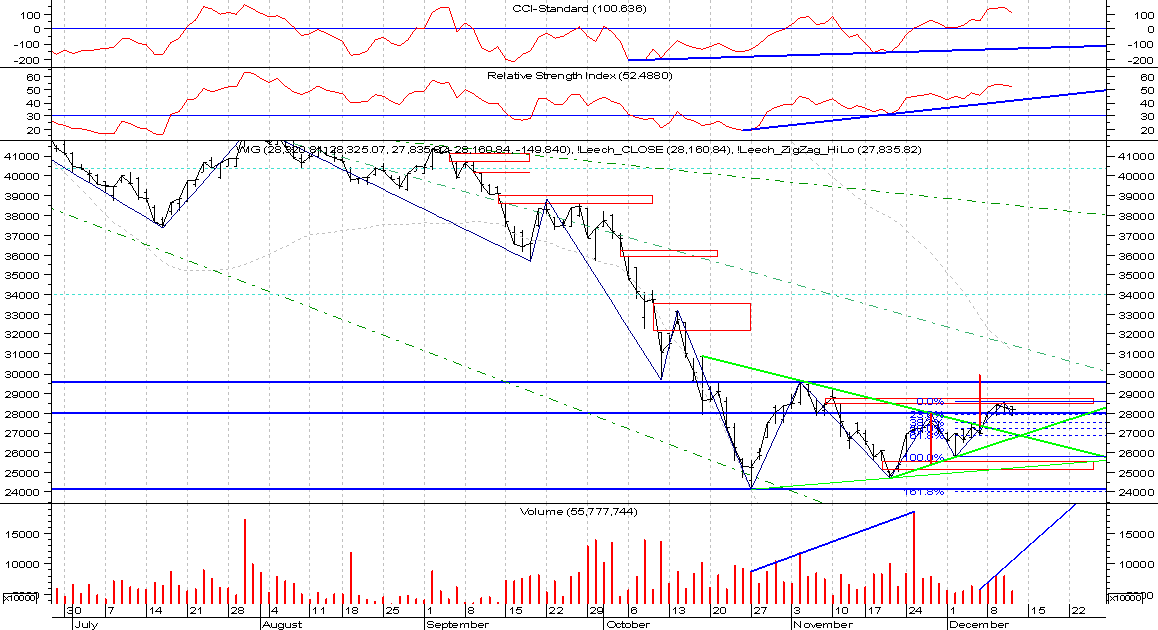

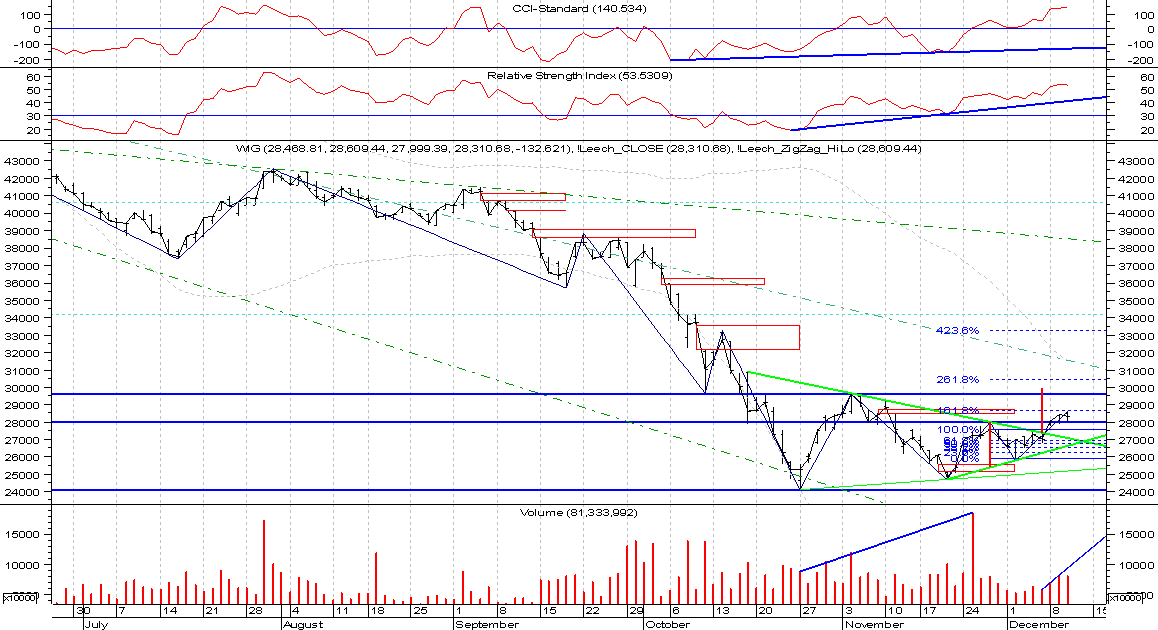

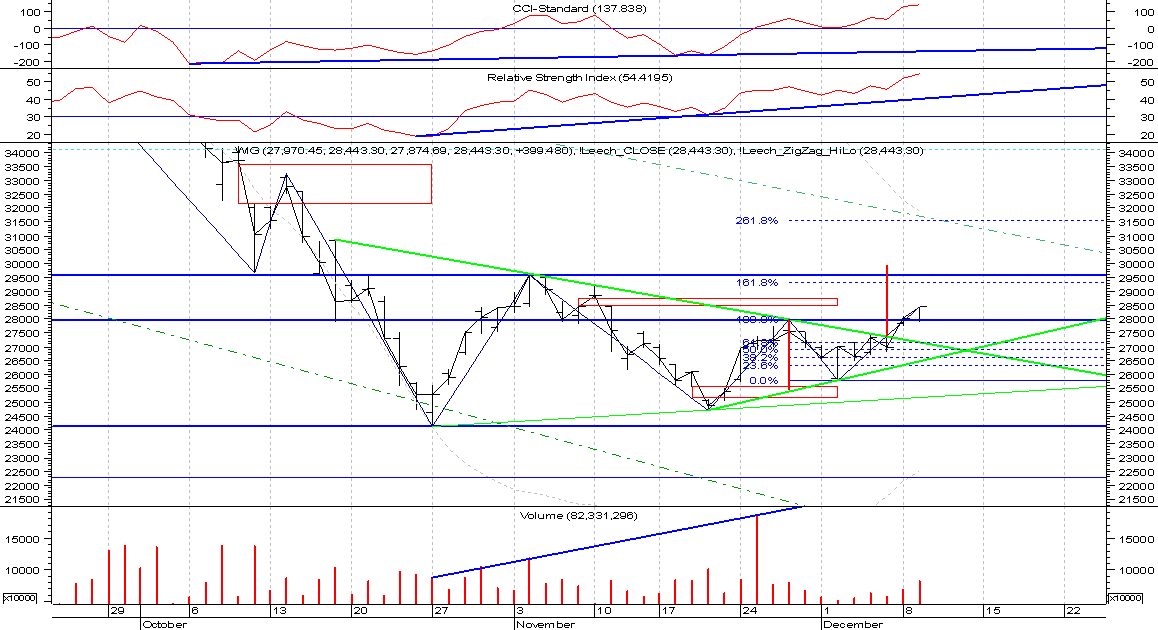

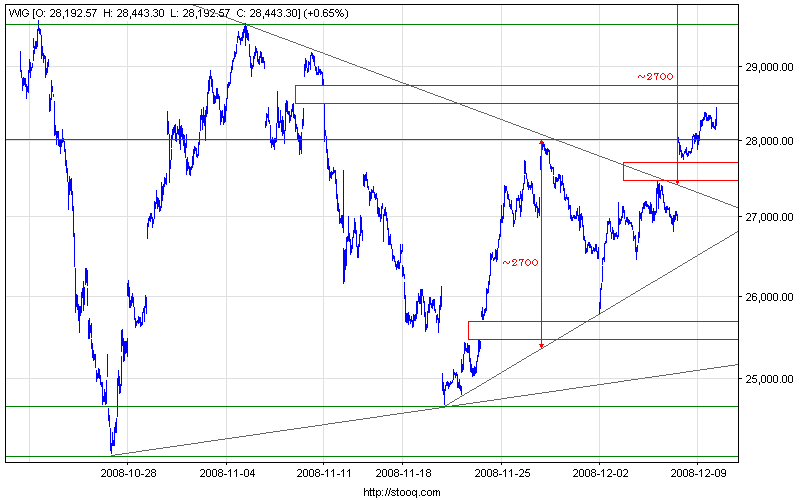

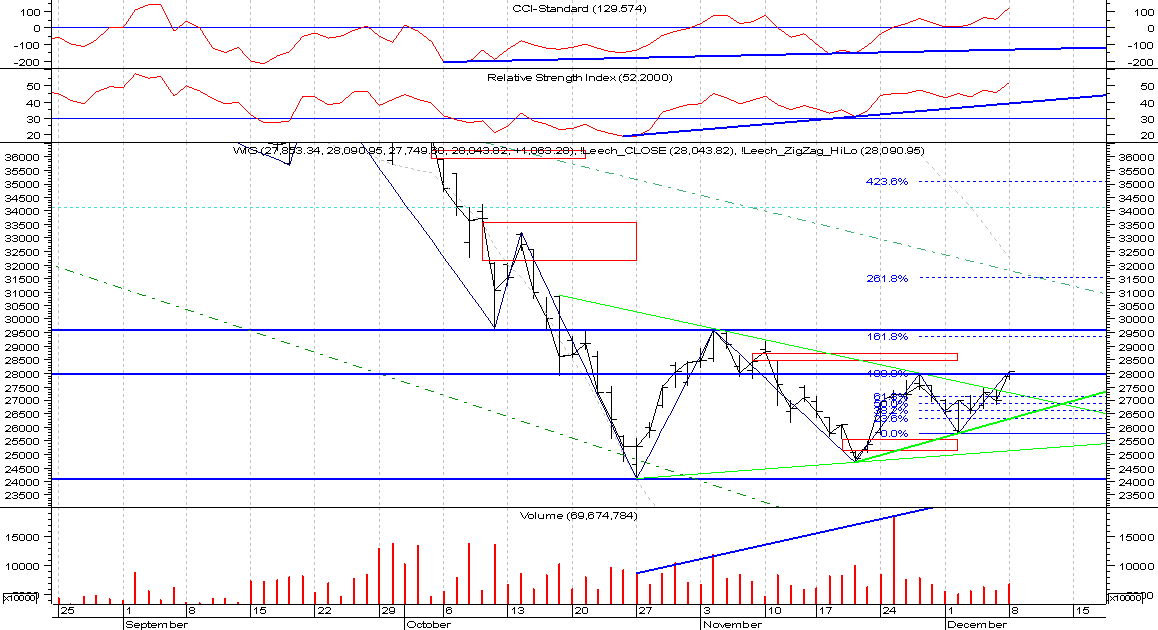

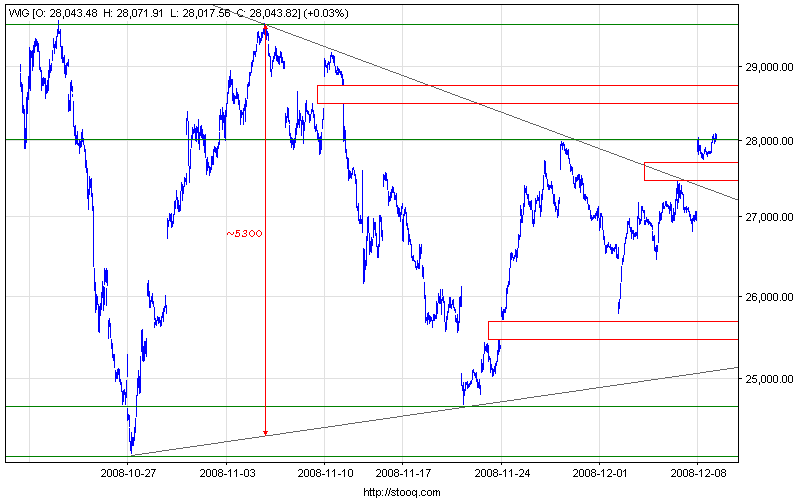

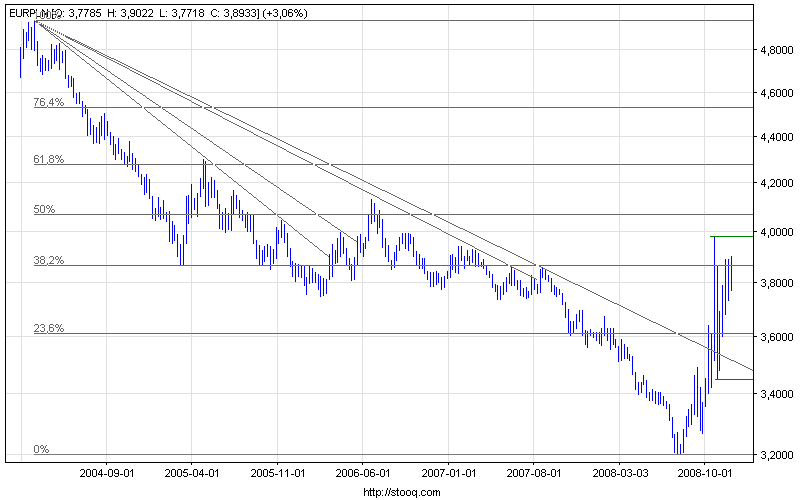

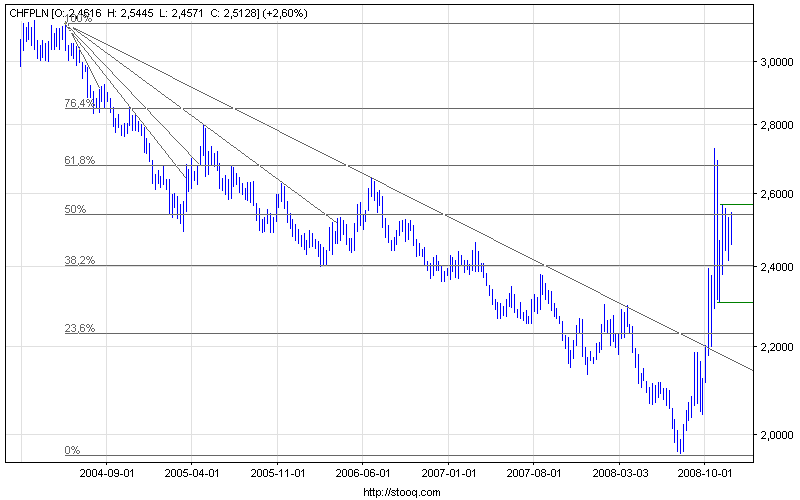

Year 2008 finished in a painful consolidation. General situation is not clear, this can be just steeping stone in free fall continuation or the long awaited-bottom:

What was the most important lesson this year? I believe it was to cut losses while they are still small. When primary trend is broken, we shouldn't hope there will be reversal, so we can retrieve our money. The price is important, not our feelings.

The Madoff's scam (here) as well as hedge funds speculative actions (here, anyway - they are supposed to be speculative) has damaged investors' trust in finance institutions. It was also the worst year since 1930 as per stock market year-to-date change (here). Those eight days will be specially remembered for sure.

There is no certain way to tell which direction market will go, but the odds are always on trend side. Calling a bottom is not a good idea with strong trend.

SaxoBank forecasts' for 2009 were presented in this post. We should also summarize the forecasts from Dec 2007 (here). Let's also listen to Jim Rogers in this video.

Happy Year 2009!

(image shamelessly stolen from here)

Sources:

[http://www.marketwatch.com/news/story/madoffs-alleged-fraud-claims-some/story.aspx?guid={C9E3CFD6-F502-4B26-817C-1A11B74448D0}]

[http://online.barrons.com/article/SB123033354851036281.html]

[http://www.marketwatch.com/news/story/US-stocks-rise-final-trading/story.aspx?guid={BBBD6586-03B8-424A-B002-96DB1CD56776}]

[http://money.cnn.com/2008/12/31/markets/markets_newyork/index.htm?postversion=2008123110]

[http://money.cnn.com/galleries/2008/news/0812/gallery.8_days_to_remember/index.html]

[http://ft.onet.pl/0,18895,advice_for_seasonal_seers_future_is_not_in_the_stars,artykul_ft.html]

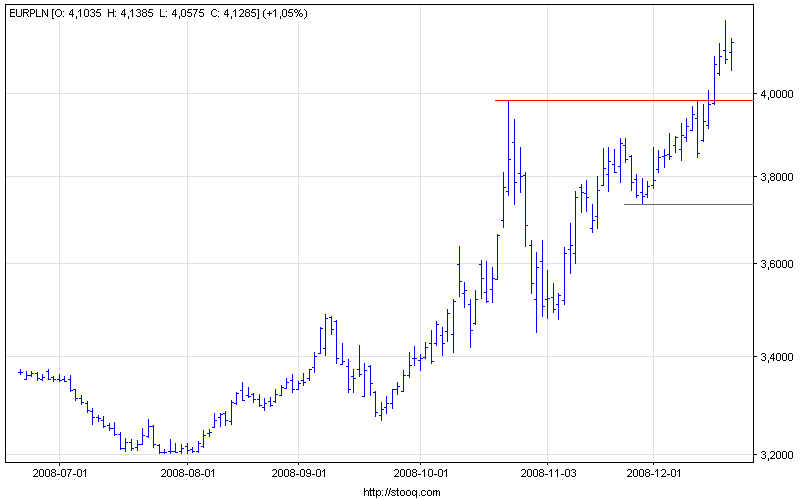

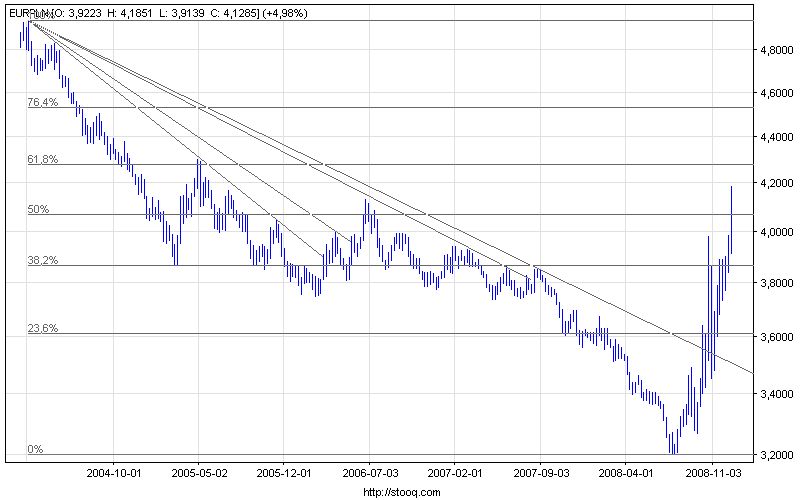

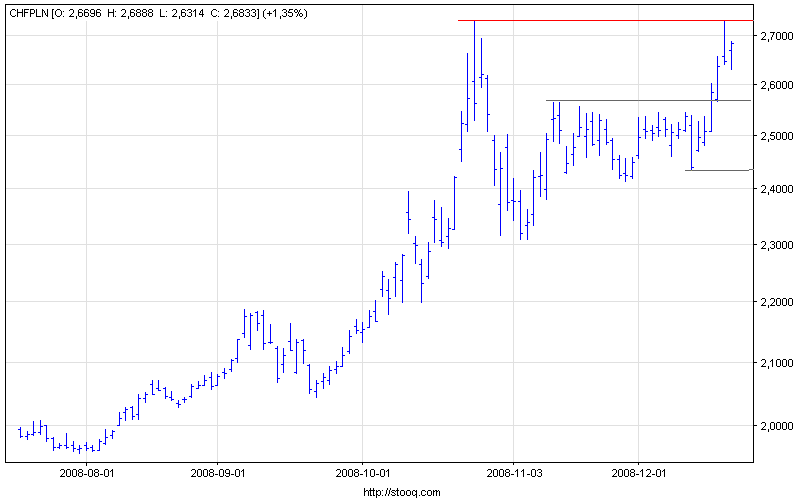

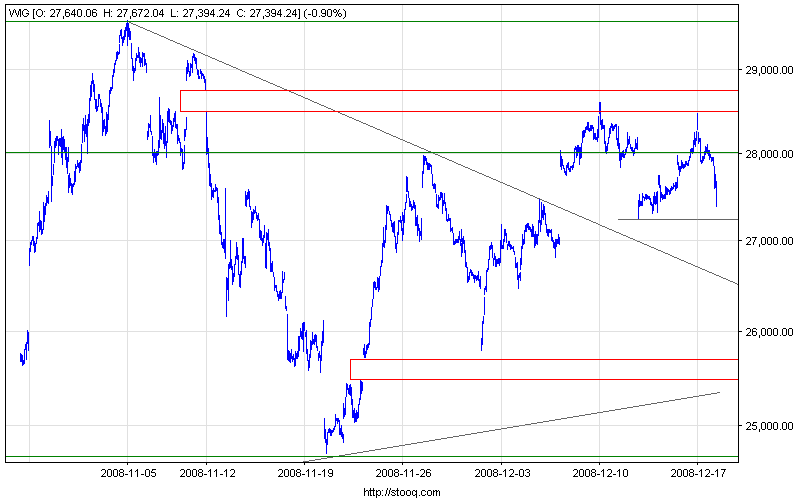

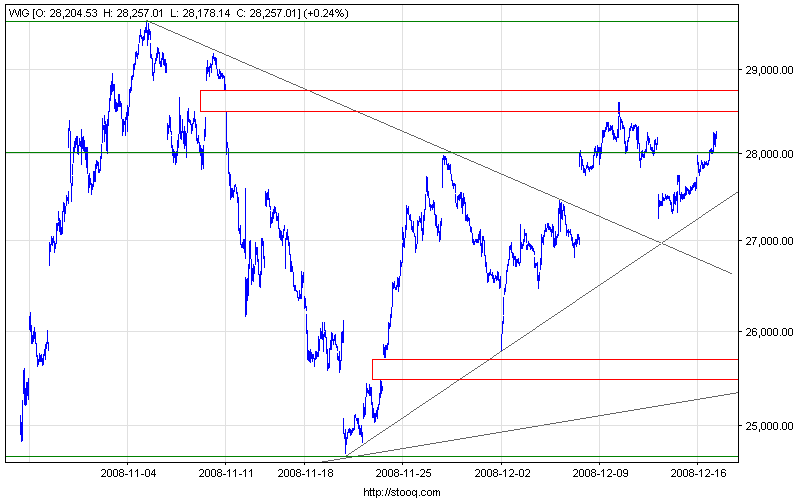

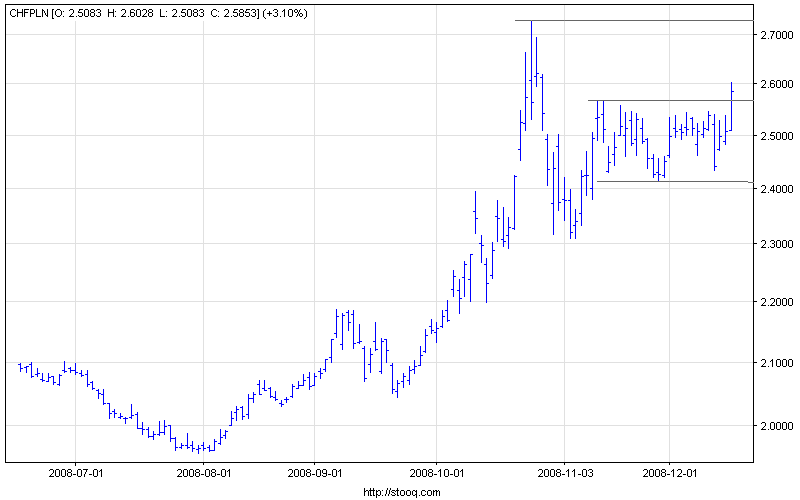

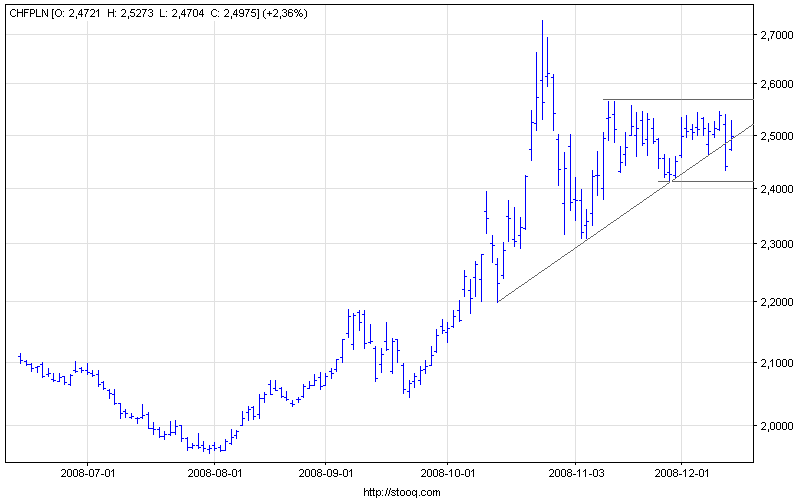

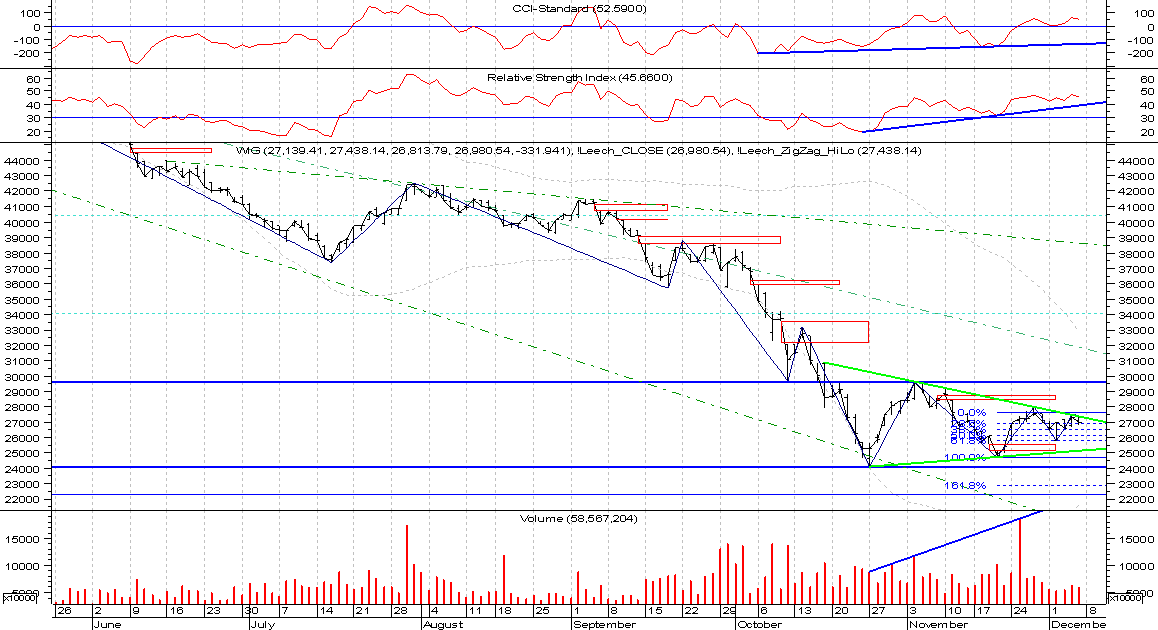

The triangle concept has not been broken, but we still have no breakout either - therefore we shall treat this formation as a potential one only.

The triangle concept has not been broken, but we still have no breakout either - therefore we shall treat this formation as a potential one only.