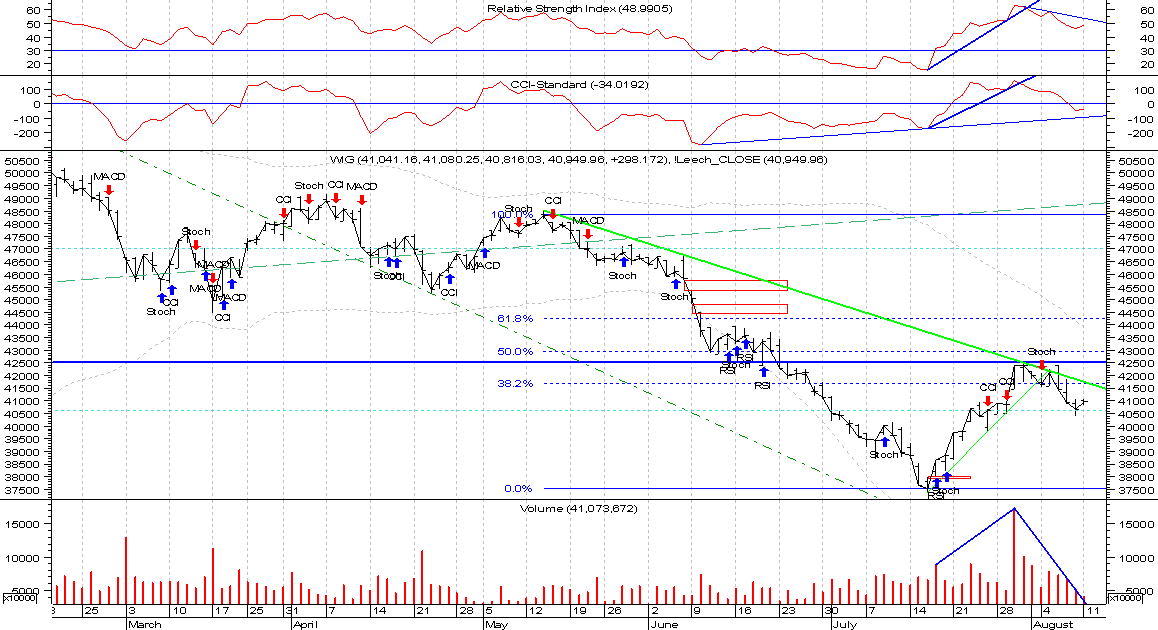

The WIG Index rallied again to downtrend line:

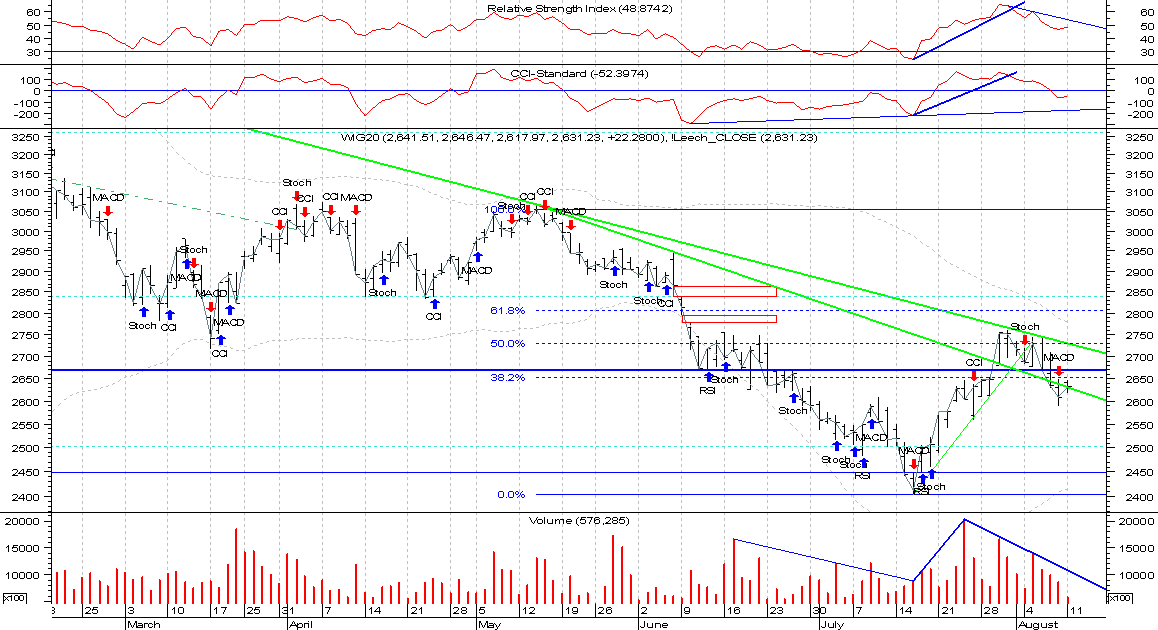

The WIG20 closed a little above the Jan low:

Now we have a chance to break through the downtrend line. The wide market is testing this line 4th time - that gives us some clues about market strength, but the next few sessions can be really important. General situation is still not clear; negative close in US will not help the market, also the RSI/CCI are showing downtrend. The move today was surprising and I think we should expect this kind of volatility in the future as well. The best course of action is to wait until market sets direction and join the confirmed trend then.

Why the current situation in US housing is called a bubble? Simply because it looks like a bubble.

Take a look at

Miami Home Price Index (thanks to

Data360 portal):

Charts for

Chicago,

Boston,

Detroit,

Phoenix and few other cities looks distressfully similar (for full report go

here).

Why it's so important? There is a number of articles in Internet (for example

here (take a look at references section),

here,

here or

here) explaining the general economy impact of failing home prices (and also owners' credit capabilities), consequences of NINJA credits (

No

Income,

No

Job &

Assets) or incoming

ARM resets. Another good idea is to read

Q2 2008 Fannie Mae Investor/Analyst Conference Call Transcript (pages 3-8 and discussion on

Alt-A mortgages are interesting).

It's a very complicated topic, hard to fully understand. I like more imaginable approach:

"Think of consumer spending power as a big pond, with a stream - consumers' personal income - flowing in from above, and another stream - consumer spending itself - flowing out from the bottom. Every now and then, the pond (personal wealth) gets higher or lower from rain (higher stock prices or home values). However, the flow from the lower end always results for the most part from inflow from the stream above."

Ahead of The Curve, J.H. Ellis

Now think of that - will you spend more money on consumption or investment, when your personal pond is getting more and more dry?

Nevertheless, don't get too pessimistic. US has very big and self-sufficient economy; mortgage and stock markets are just the most visible (beacuse you can count them) part of it.

Sources:

[

http://online.wsj.com/article/SB121805947661818327.html?mod=djemRealEstate]

[

http://seekingalpha.com/article/90265-the-mortgage-crisis-brings-unexpected-neighbors]

[

http://www.salon.com/tech/htww/2008/03/28/the_arm_reset_crisis/]