Welcome to 500th post!

Since I

started this blog in July, 2008 (with

different provider), when economic situation looked disastrous.

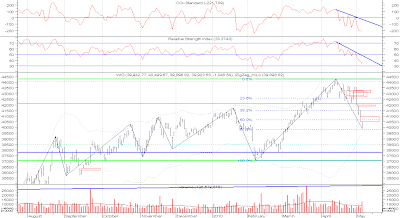

Next, we have fallen almost to 20000 and rebounced from there. The WIG Index was then at more or less same level as today (ca.40000).

What helped us to dig out from this recession was gigantic stimulus packages from governments worldwide.

The money injected into financial sector caused much controversy.

The governments went into heavy debts and those money will have to be, at least partially, paid from taxes (there is also inflationary scenario).

It is safe to assume, the net amounts we take from our work will be taxed more and social spending will be generally lowered (that also includes our future pension). Therefore, I would rather advise to plan our financial future on our own and don't count on national pension at all. The demography and Poland's external debt is not helping (i.e.:

this post).

In summary, the crisis might be over, but the bill still has to be paid.

When I started this blog, I was under impression, that financial markets are for everyone. It is not true; successful investing requires discipline, knowledge, time and capital.I was lucky enough to enter market just in the right moment (

this post, March, 2009), but I didn't use the bull market to its full potential.

Unfortunately, there is no other way to learn than experience. Some of my strategies were clear failure; however, I found few, that are very useful and work for me (IMHO, trading methodology is very individual).

This is one of my firsts published charts:

For example, the oscillators' signals are not working for me, but divergences are useful.

I still don't know how to read volume patterns.

Also, I don't use patterns so much any more (only few of them: double top/bottom and head-and-shoulders) - they are too subjective. The same goes for trendlines (especially in Forex market):

I have learned many other things about finance world and economy in general; some of them are useful for life (financial planning, keeping income/outcome books); some of them are for very specific domains only (price action for currencies).

What are plans for the blog's future? No much of a change really.

Right now I am focused on my second project and I have moved almost all my capital there. However, I will be back to market eventually, as soon as I have finished with that investment (and assuming the bull market will continue).

At the end of this entry, I would like to wish you all good trades: huge gains and small losses (which are inevitable unfortunately). Always remember to use stop-loss orders and sound money management system.

However, never forget - money are just a tool - not a target! Your life (and yours family) always comes first.