The EURPLN still moves between 4.00 - 4.20:

The CHFPLN has generated strong buy signal, when level of 3.00 has been broken:

That's a definitely buy signal and those are not good news for polish mortgage owners.

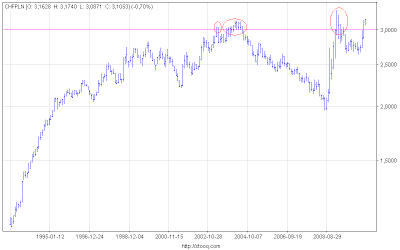

However, let's take look at long-term chart:

What is worth mentioning is this psychological level of 3.00 has been broken four times in last 15 years. Last time exchange rates went as far as ca.3.35.

Over few years I have learnt, that forecasting Forex market is next to impossible; nevertheless, in my (very subjective) opinion, that is the level we should be watching now.

For polish mortgage owners - your mortgages are most probably to be paid in 20-25 years. That is a very long time, there will be few crises during that time and anything can happen. Therefore, do not panic - I believe the rates are still smaller than mortgages in PLN.