The EURPLN has made another lowest low:

The price is still in tolerable range below psychological 4.00 - that prevents us from generation primary sell signal. However, we need to remember, the EURPLN is in primary downtrend and any rally should be used to reduce our exposure only.

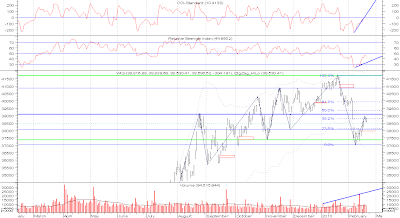

The CHFPLN is in consolidation:

Unfortunately for polish mortgage owners, the CHFPLN chart does not show any sign of weakness.

The Greece's financial deficit is causing further EURUSD slide (here). Nevertheless, we need to note, the weaker the EURO, the more competitive Euro-Zone's economy is.

Switzerland has quite interesting situation, as Swiss banks have quite big exposure (relatively to total amount) to Greece (here or here).

Sources:

[http://socioecohistory.wordpress.com/2010/02/13/europes-exposure-to-pigs-problem/]

[http://www.thenewamerican.com/index.php/world-mainmenu-26/europe-mainmenu-35/3034-greece-euro-and-even-the-eu-on-the-ropes]

[http://www.guardian.co.uk/business/2010/feb/11/greece-debt-france-switzerland]

20090415

16 years ago