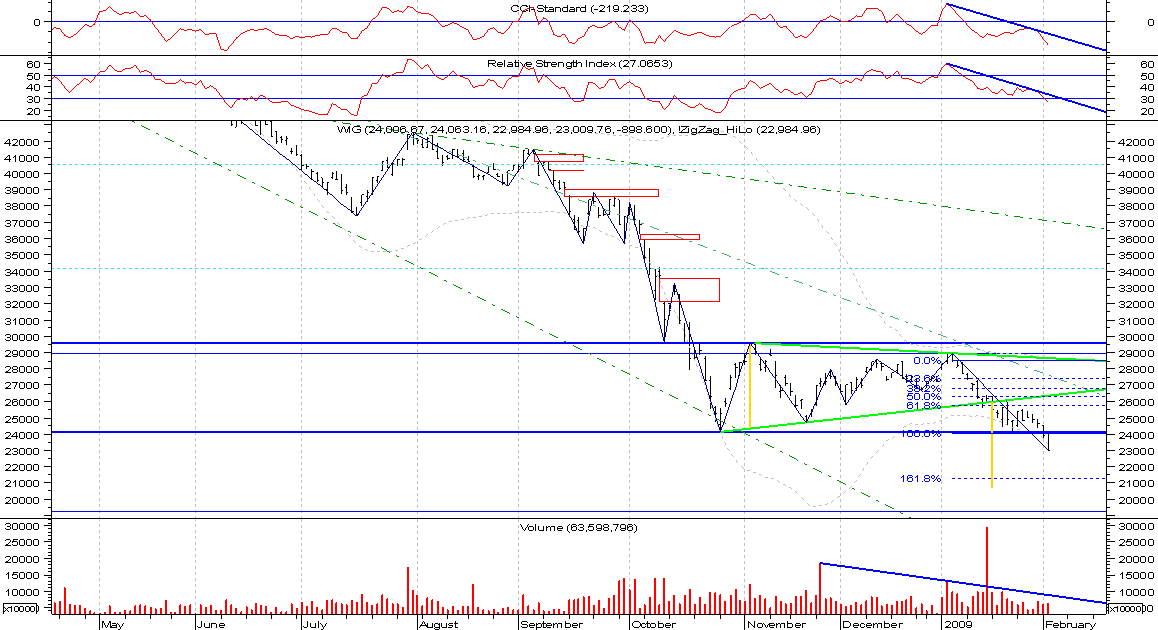

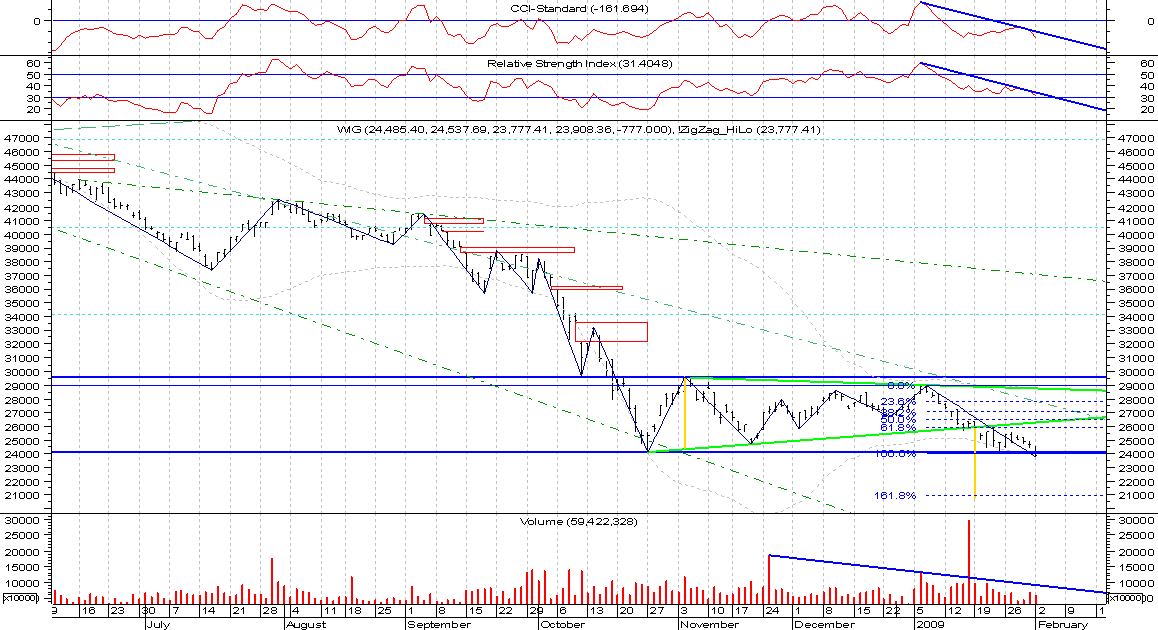

As per yesterday's post - not much can be said and we have to wait for market actions. The primary trend still favors south direction.

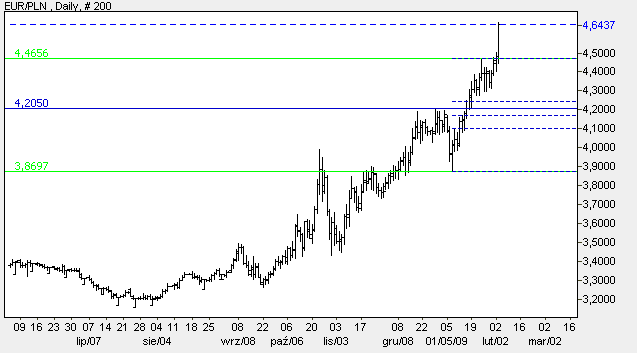

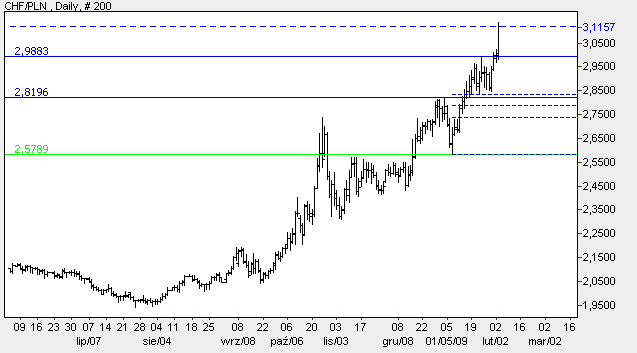

The Polish Monetary Policy Council lowered interest rates by 0.25% to 4% (here).

As per Holder portal, 56.5% of total polish mutual funds' transactions were selling shares (here).

The Northern Trust partied a little bit too much (here or here).

I'll be out for a week, therefore don't expect new updates during this time.

Sources:

[http://www.thedisciplinedinvestor.com/blog/2009/02/24/party-at-northern-trust-concert-and-drinks/]

[http://news.morningstar.com/newsnet/printNews.aspx?article=/dj/200902241803dowjonesdjonline000652_univ.xml]

[http://gielda.onet.pl/0,1923276,wiadomosci.html (via Google Language Tools)]

[http://www.holder.com.pl/fm.shtml?id=6727&fm=11154&c=37378025020 (via Google Language Tools)]