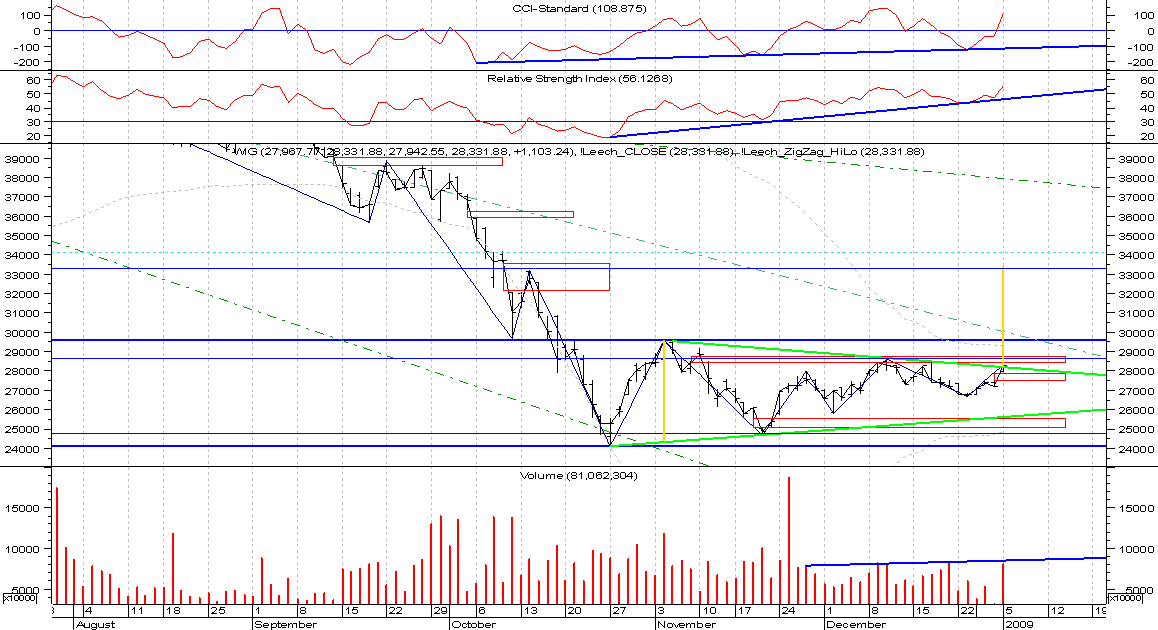

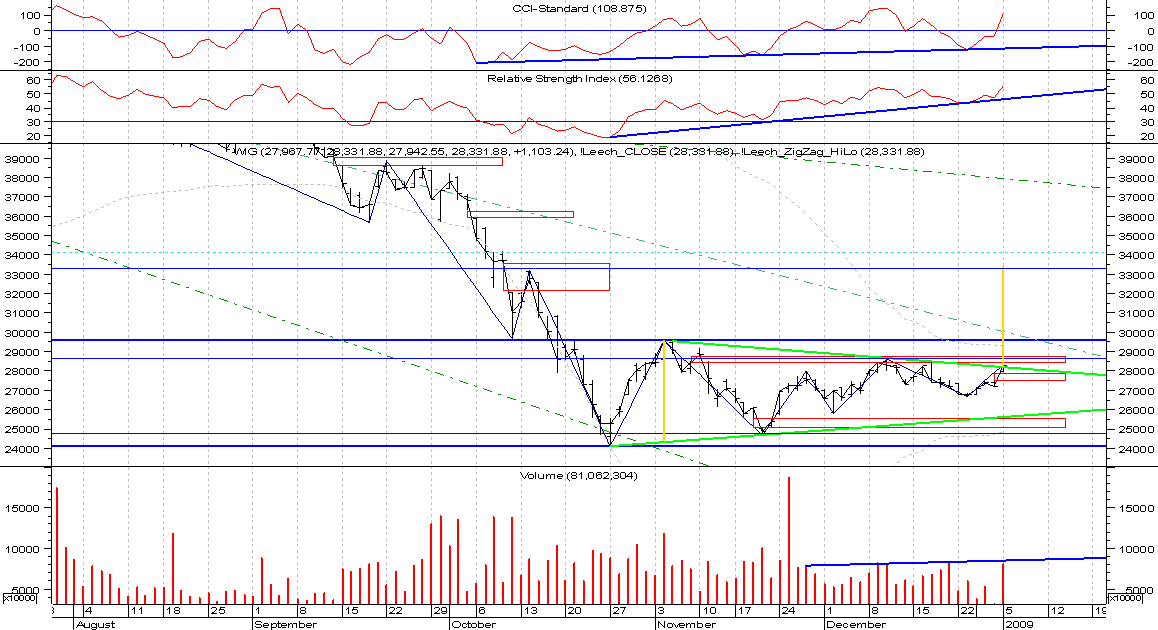

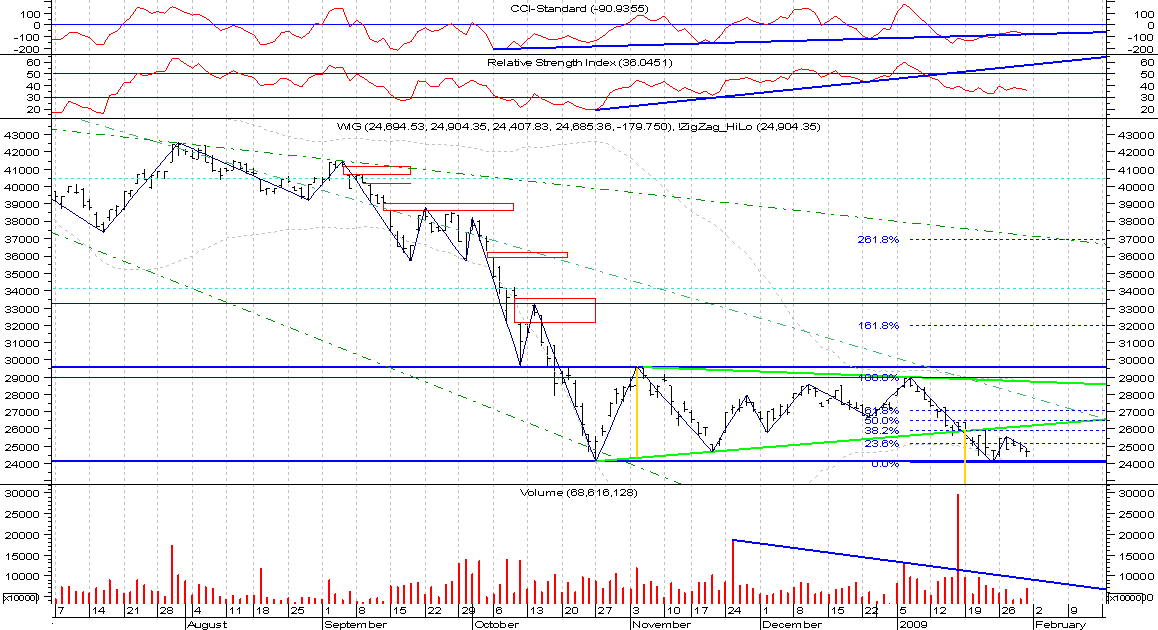

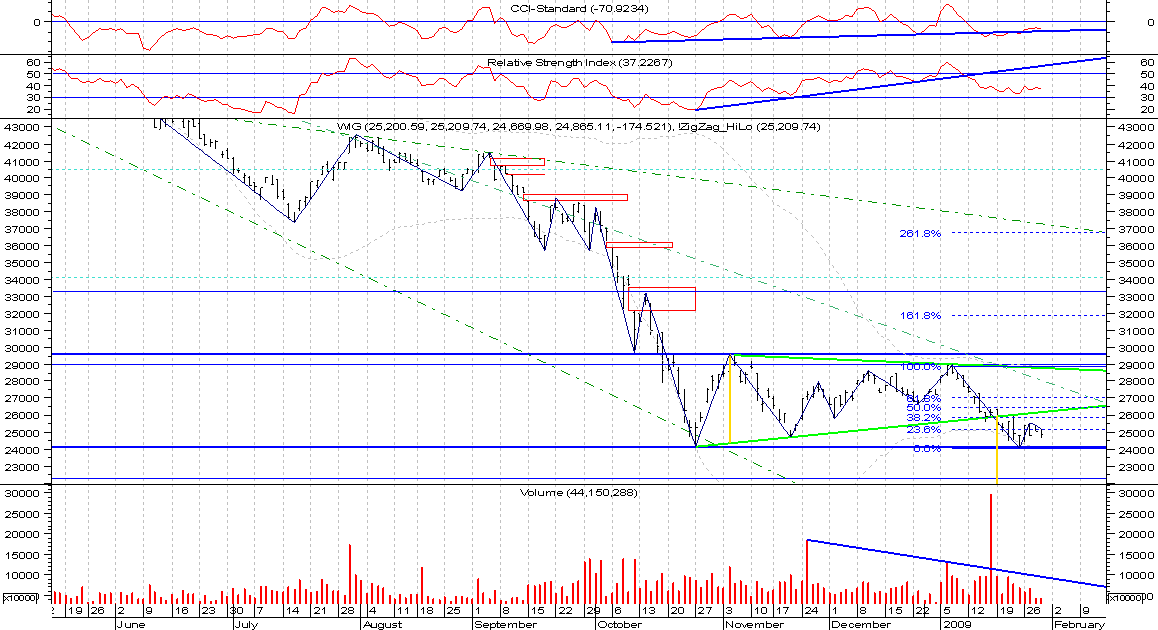

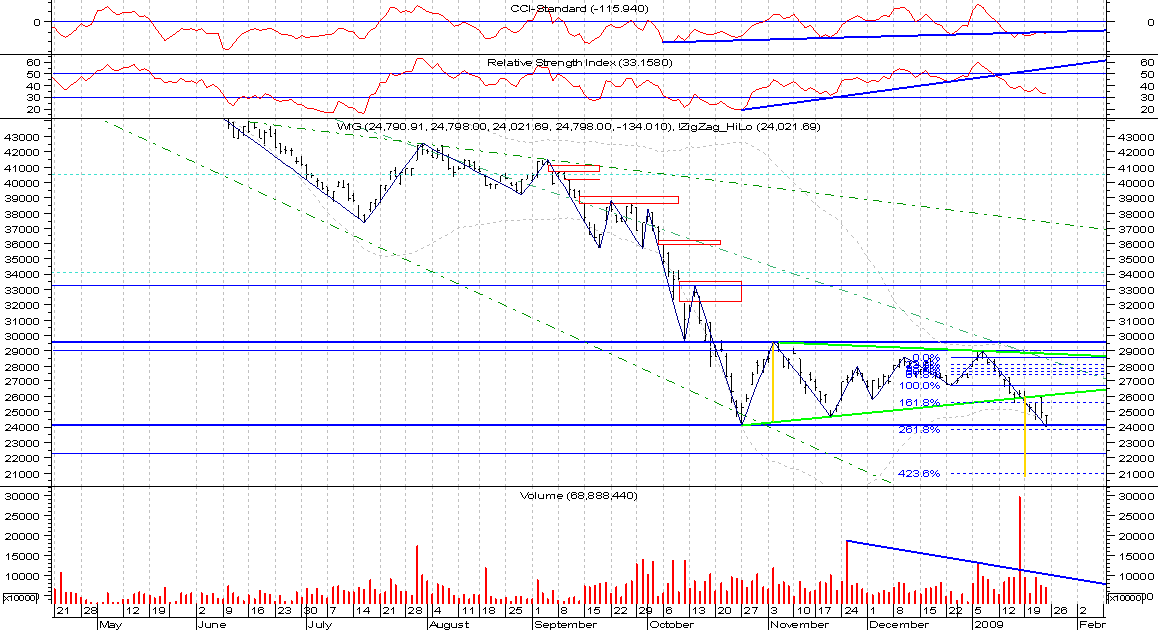

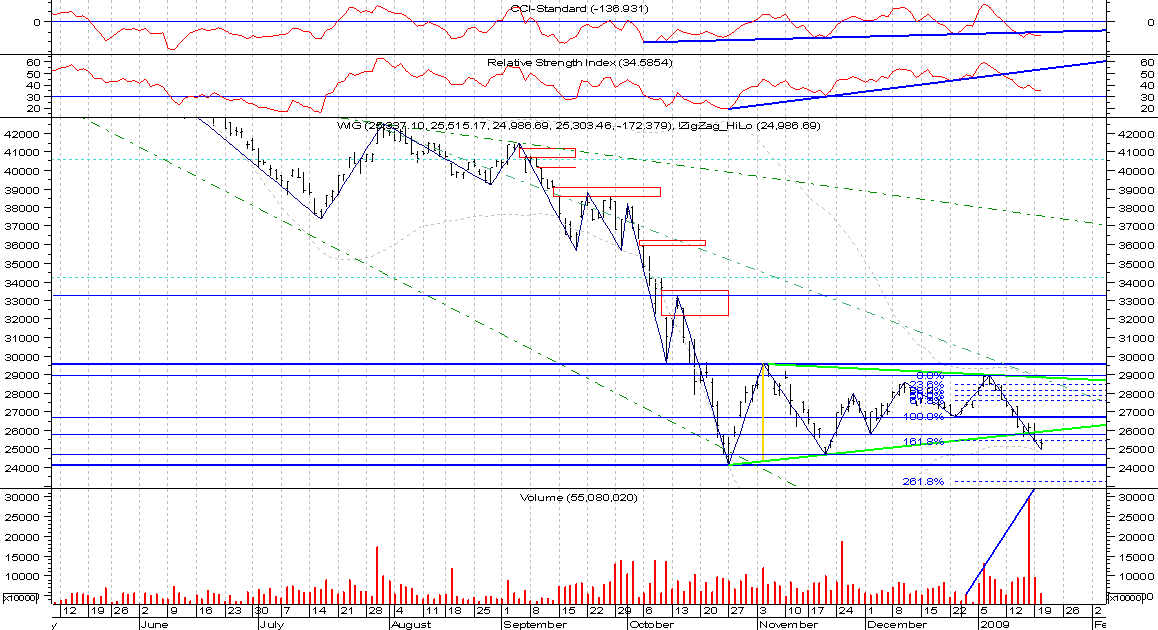

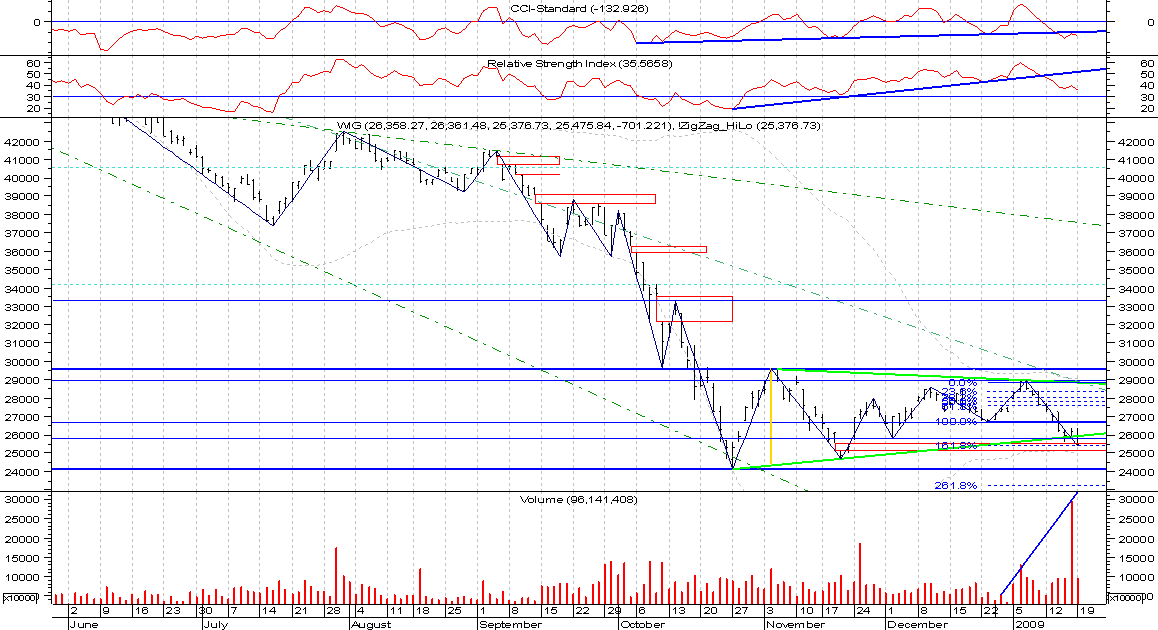

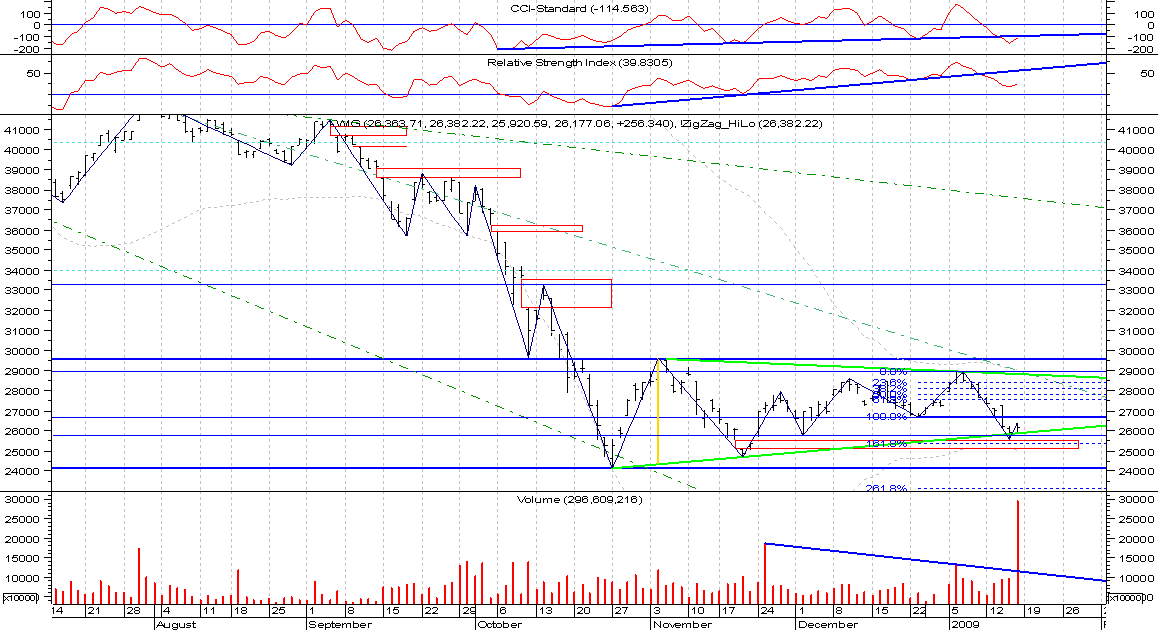

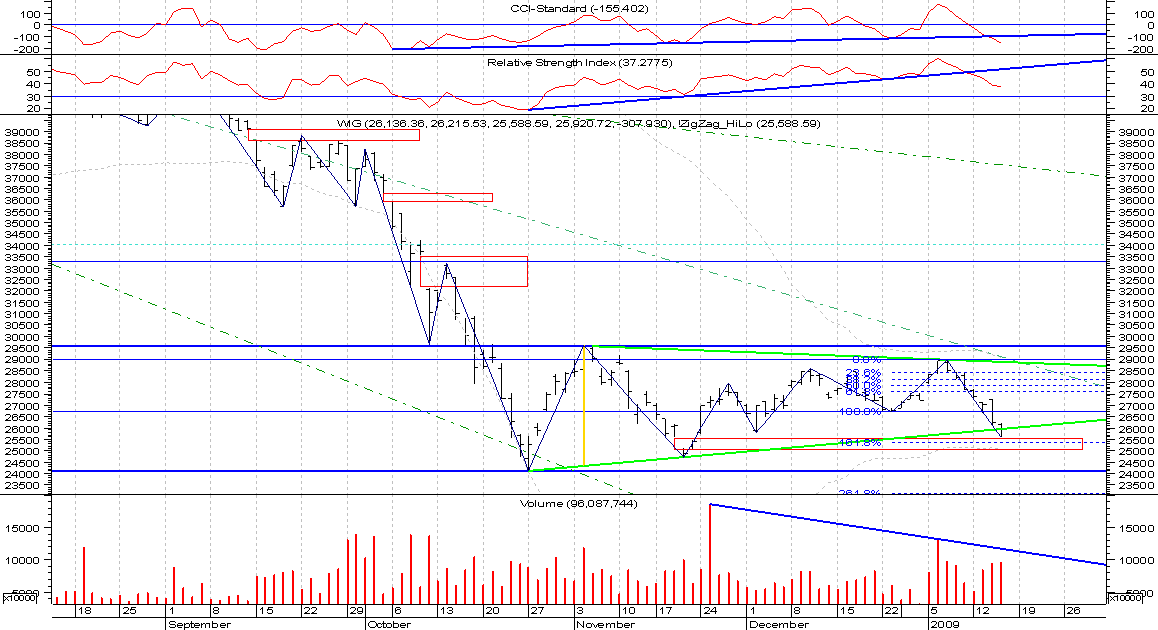

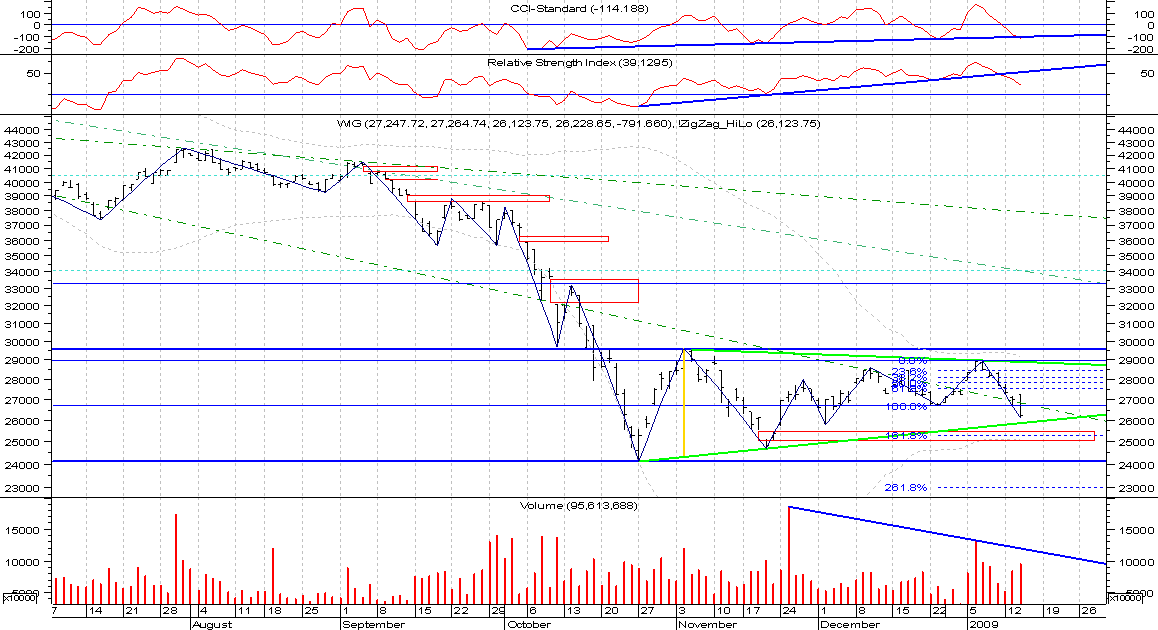

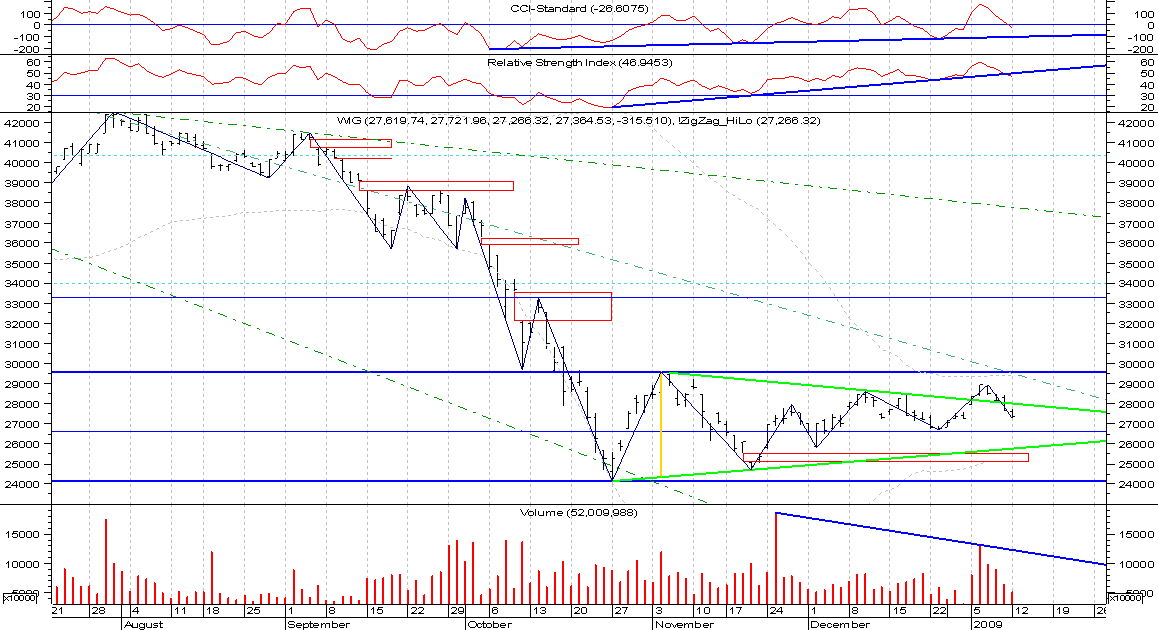

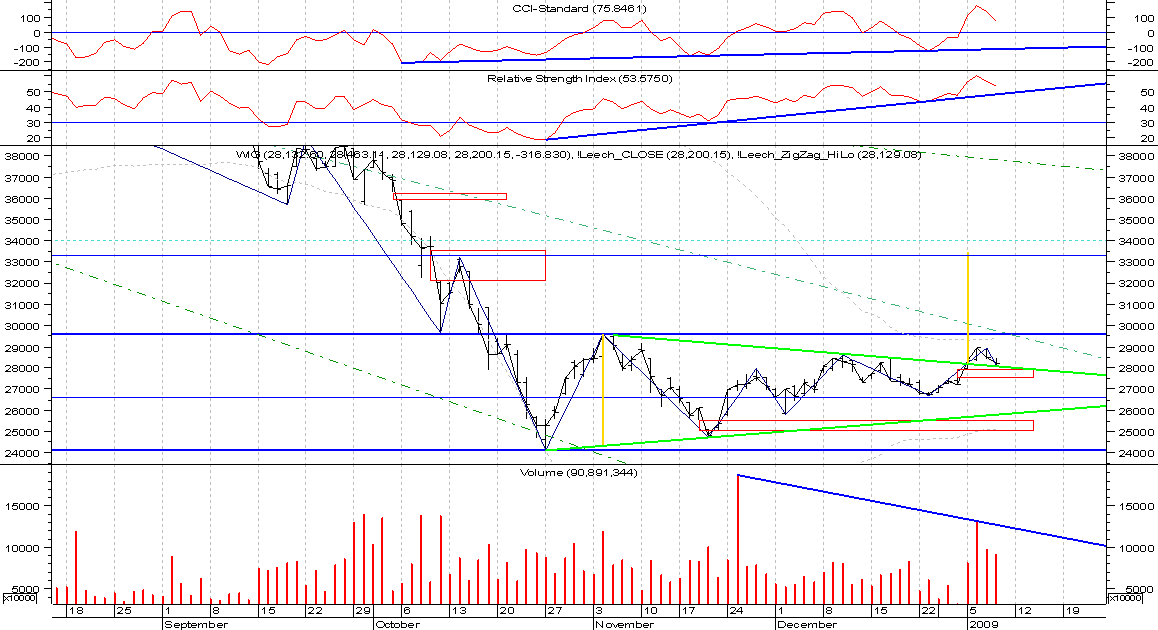

First session in 2009 showed us great rally with huge open gap:

We can hope this rally won't end soon and target level (ca.33400), however at first we should cross the important level of 29600, preferably also confirmed by high volume. Today's gain was huge, but we shall be still careful.

Warren Buffett seems to be optimistic in long term (five years), but bearish in short term (five months) - article

here.

Some more gloom & doom predictions for 2009 (

here).

And Brian Shannon's video

here.

There is an interesting article (

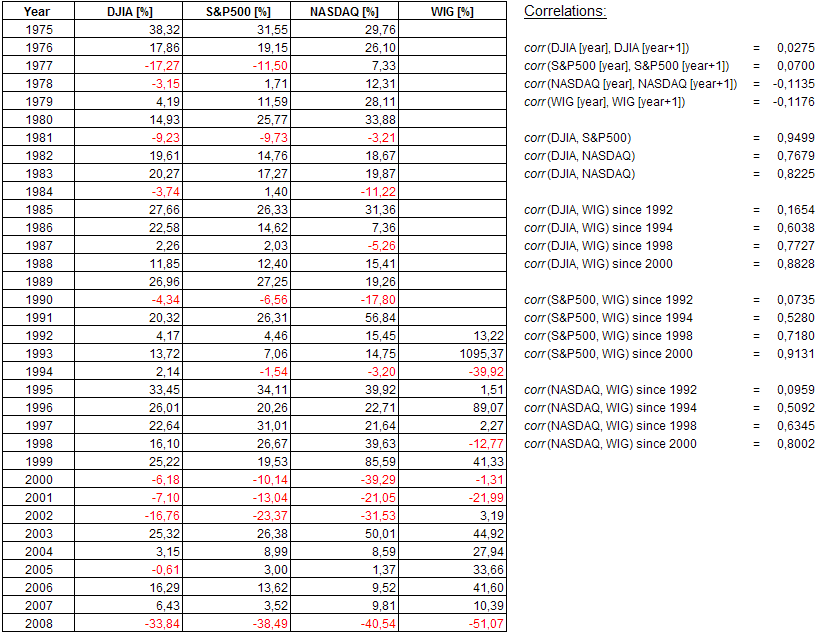

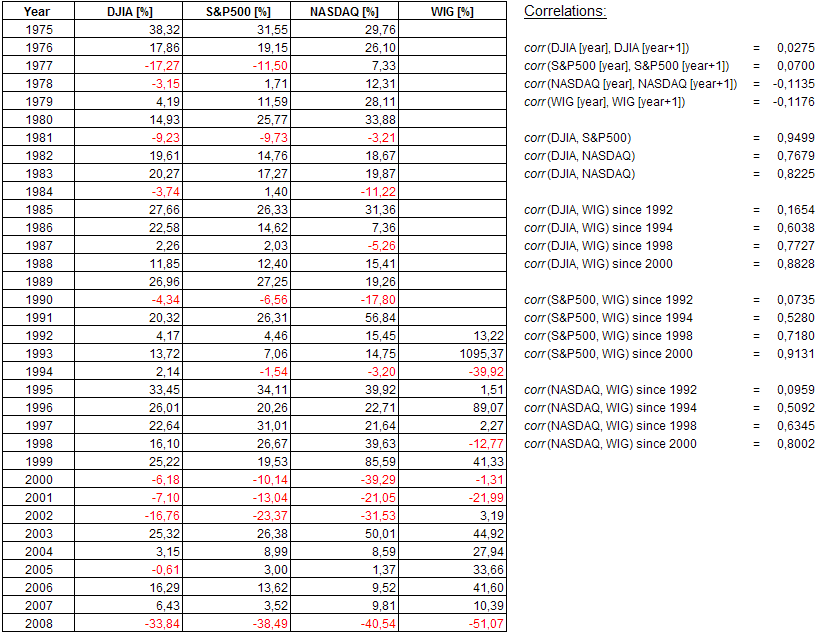

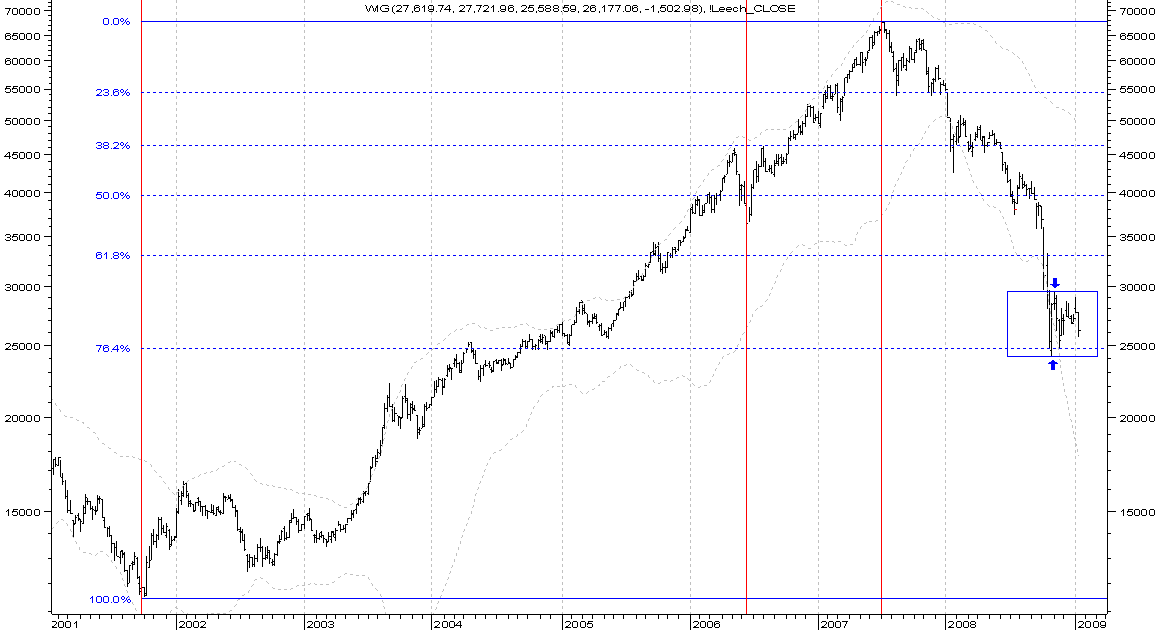

here), where author come to conclusion that yearly stocks return are almost purely random. Let's see how it looks in last few decades for polish market:

Years' returns for DJIA, S&P500 and NASDAQ indexes are taken from

1stock1 site (

here). Correlation coefficiency near zero mean the variables are almost independent; values close to 1 or -1 mean there is linear relationship (with positive or negative direction).

Correlation is well explained in

Wikipedia.

The polish market was very active in his first years (ten-fold gain in second year), therefore correlation values between US markets and WSE were low. Since 1998, we can note high correlation to US market.

The near zero correlation values for year and year+1 for those index show there is almost no correlation between preceding year's return and current year's return. Therefore, statistically speaking, we shall not expect any rebounce in 2009 only because 2008 year had great loss.

Sources:

[

http://market-ticker.org/archives/689-Where-We-Are,-Where-Were-Heading-2009.html]

[

http://www.marketwatch.com/news/story/Buffett-put-20-bln-work/story.aspx?guid={C55B33D2-BB7A-4636-B38F-5F1202B44E42}]

[

http://www.marketwatch.com/news/story/A-review-stock-market-2008/story.aspx?guid={C804E9C8-2C7C-4E33-84E6-9A056024E3AE}]

[

http://www.1stock1.com/1stock1_142.htm]

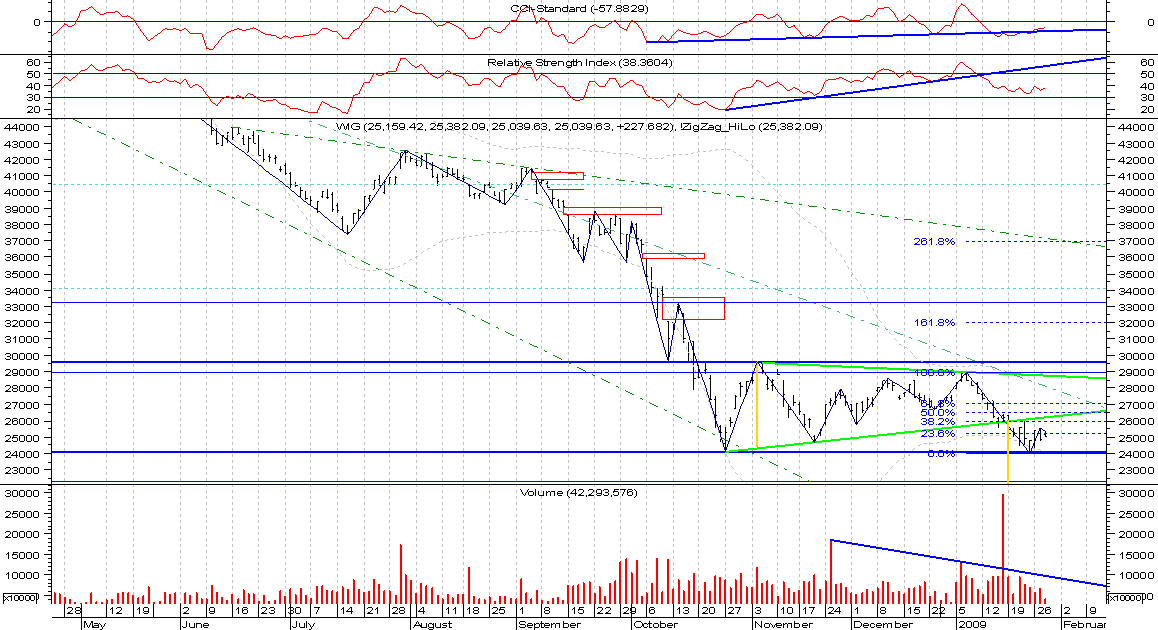

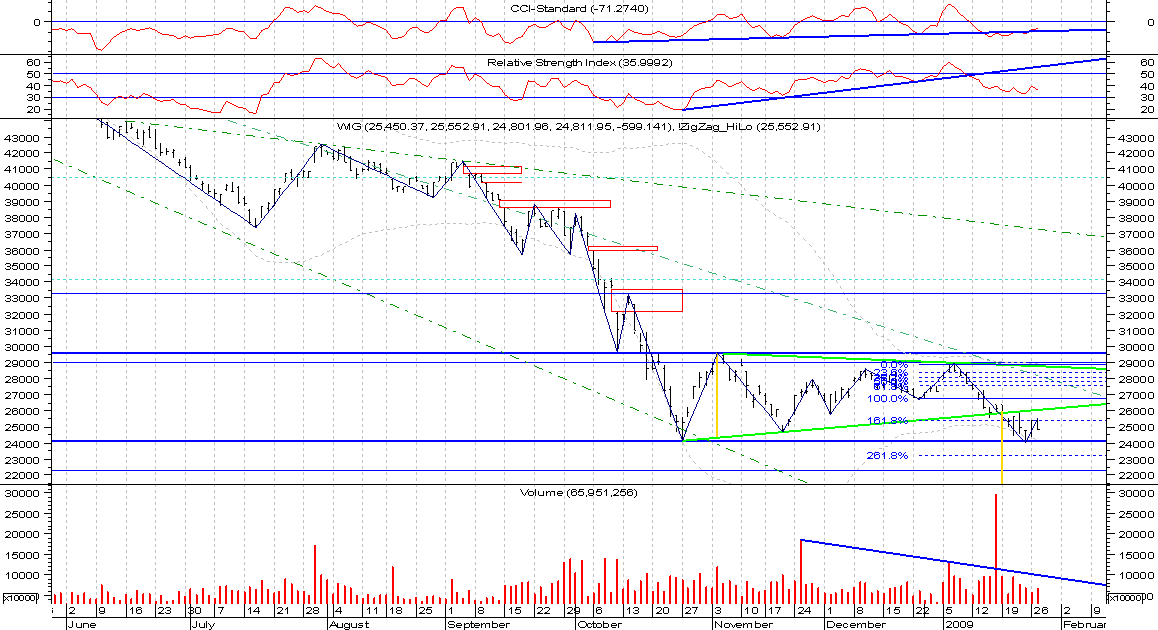

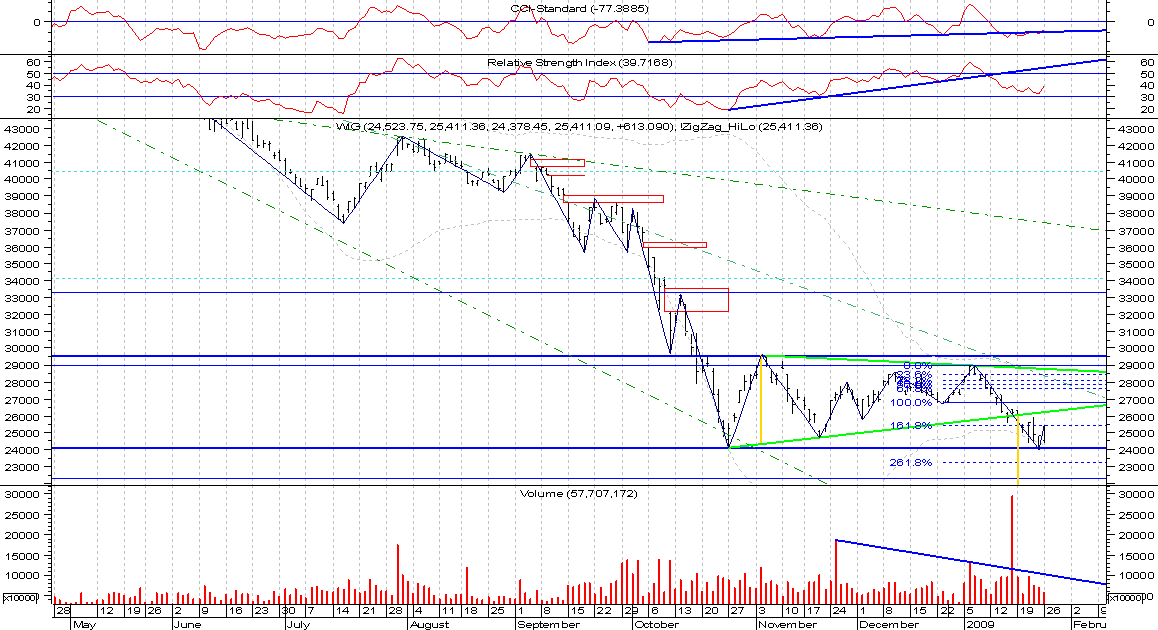

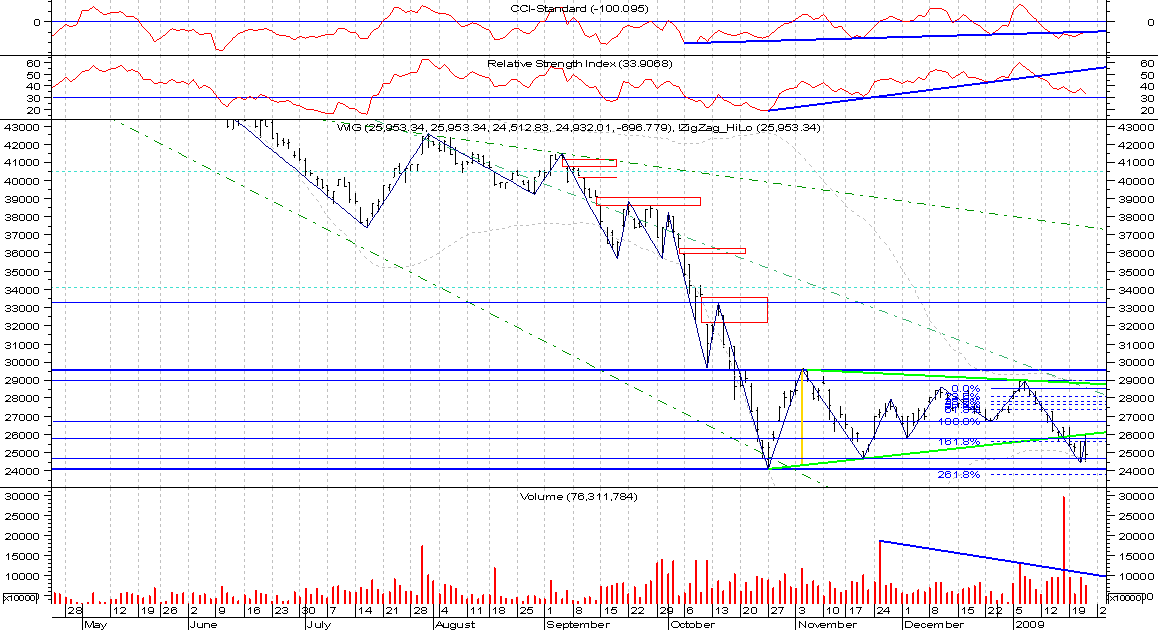

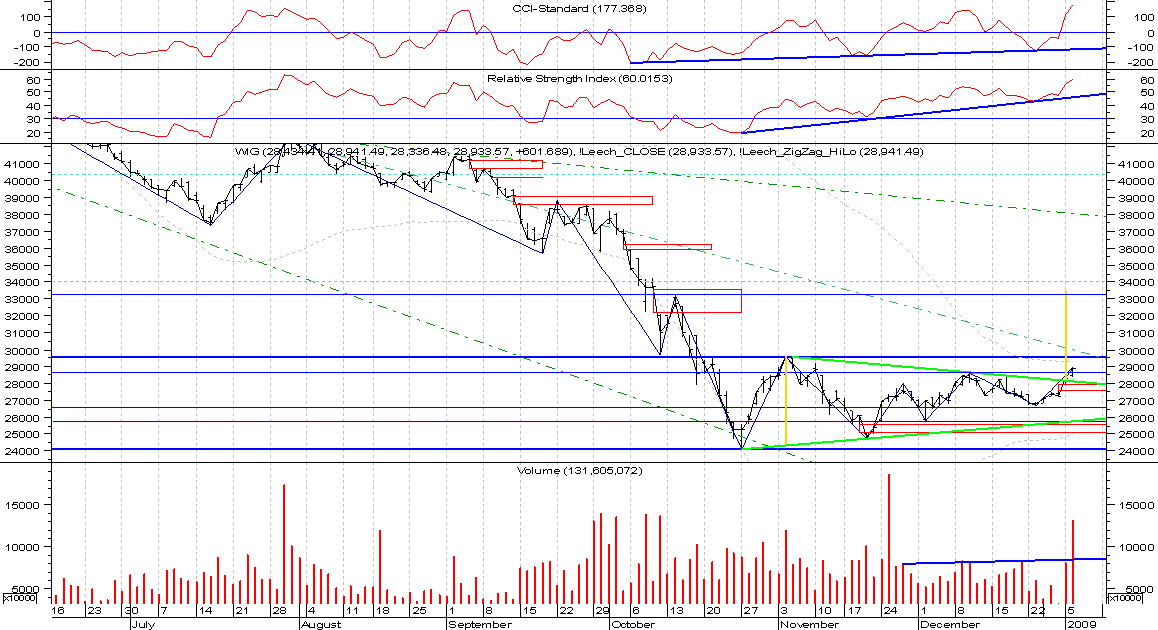

We shouldn't make any forecasts (ever), but we should note well visible uptrend (higher high & higher low pattern). The overall situation has not changed and we are waiting for 29600 (or continuation of fail).

We shouldn't make any forecasts (ever), but we should note well visible uptrend (higher high & higher low pattern). The overall situation has not changed and we are waiting for 29600 (or continuation of fail).

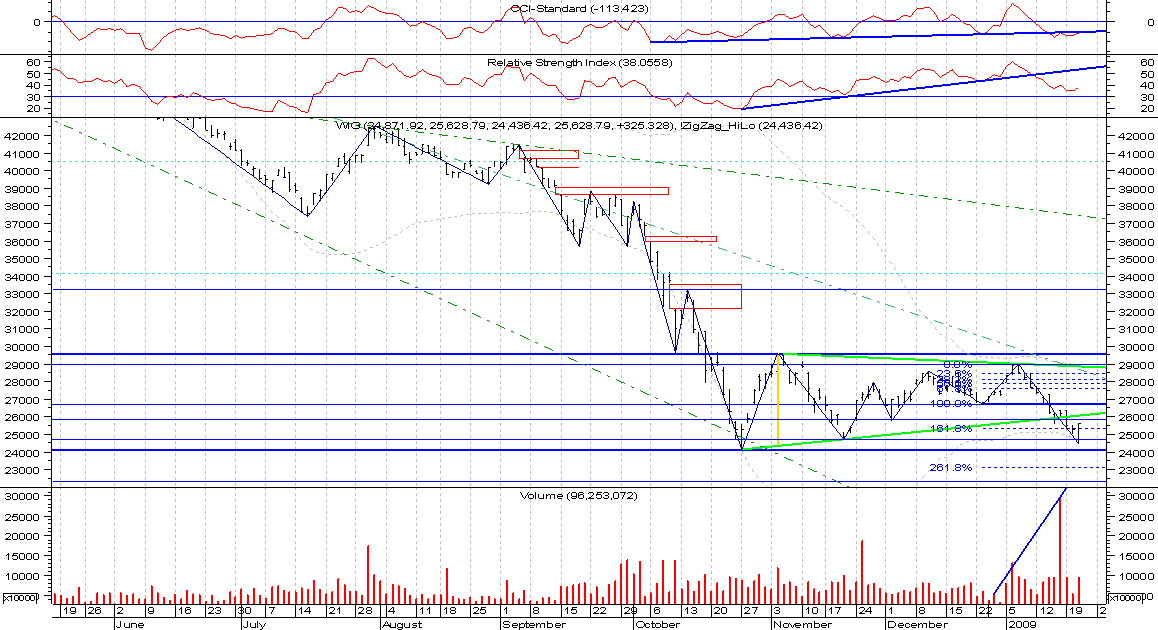

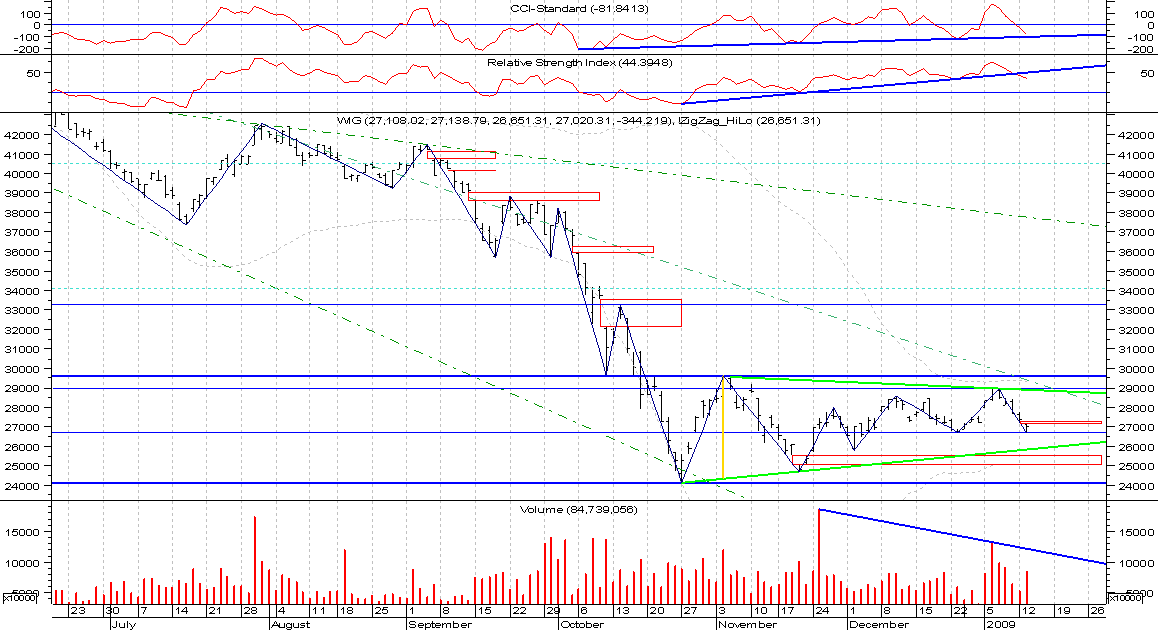

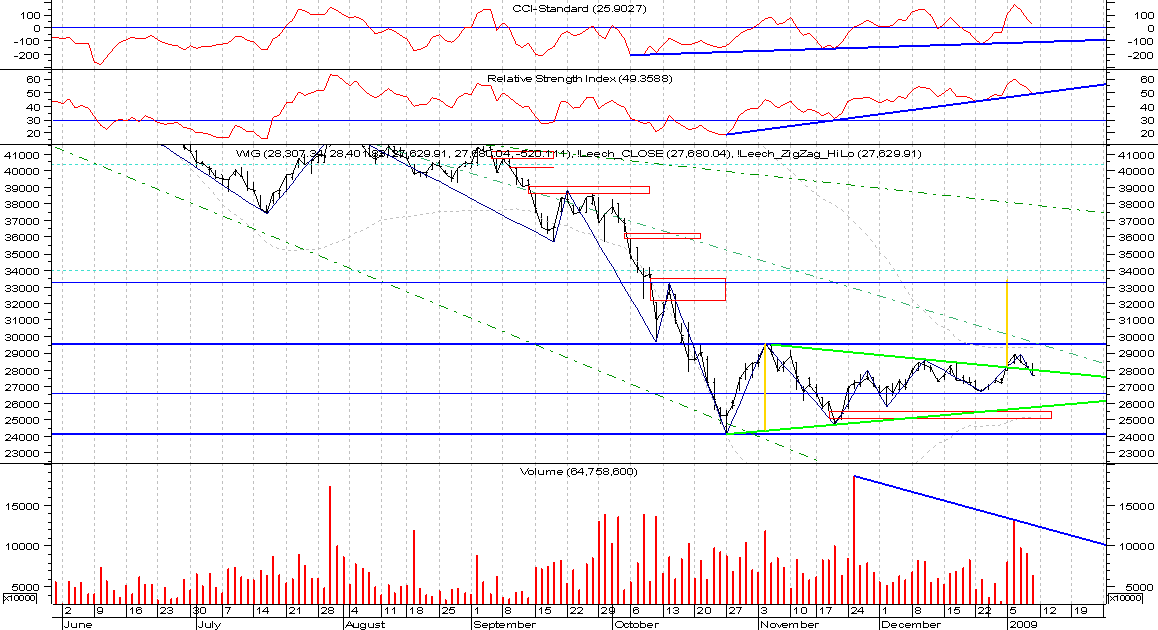

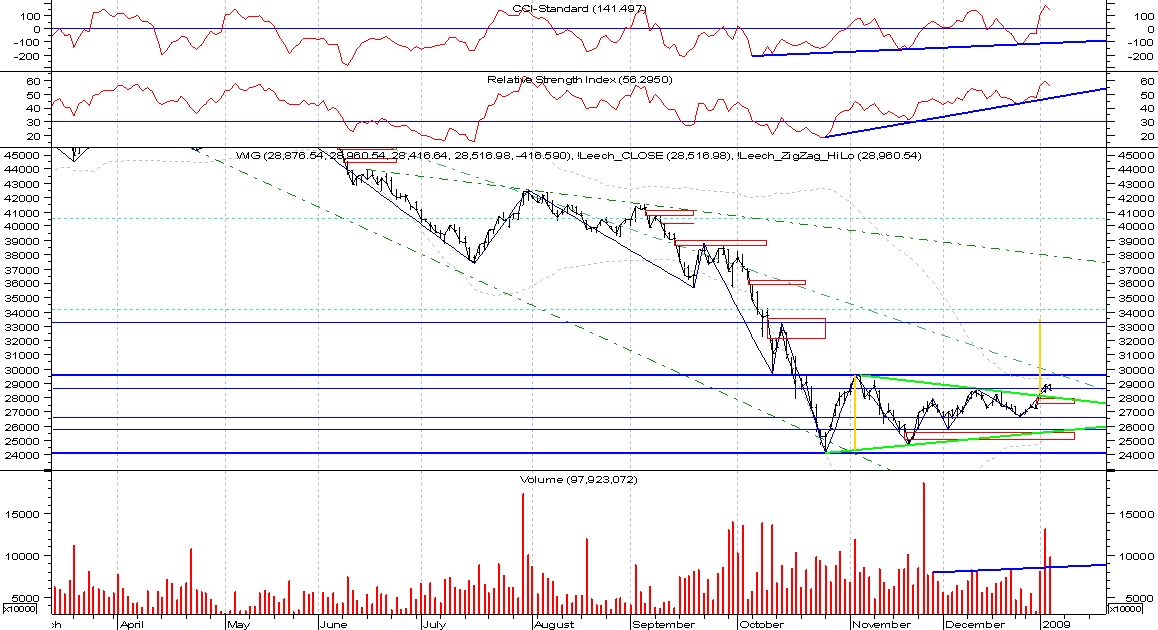

The WIG Index has broken the level of 28600 - weekly high from 10th Dec 2008. That generates another buy signal on long-term. However, the real test will be the level of 29600 (we are quite near it).

The WIG Index has broken the level of 28600 - weekly high from 10th Dec 2008. That generates another buy signal on long-term. However, the real test will be the level of 29600 (we are quite near it).