Welcome after long break. My secondary project is going quite well, however it still need some work. Therefore, I think the posts could be less regular for a moment.

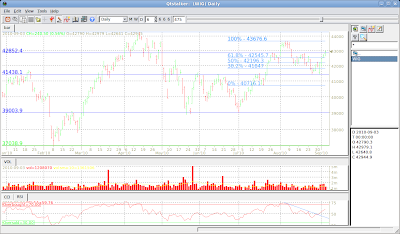

The WIG Index gain +1.26%:

The daily buy signal has been generated (at 42850) and we are again at important level. Crossing primary high (ca.44300) will generate confirming primary buy signal.

20090415

15 years ago