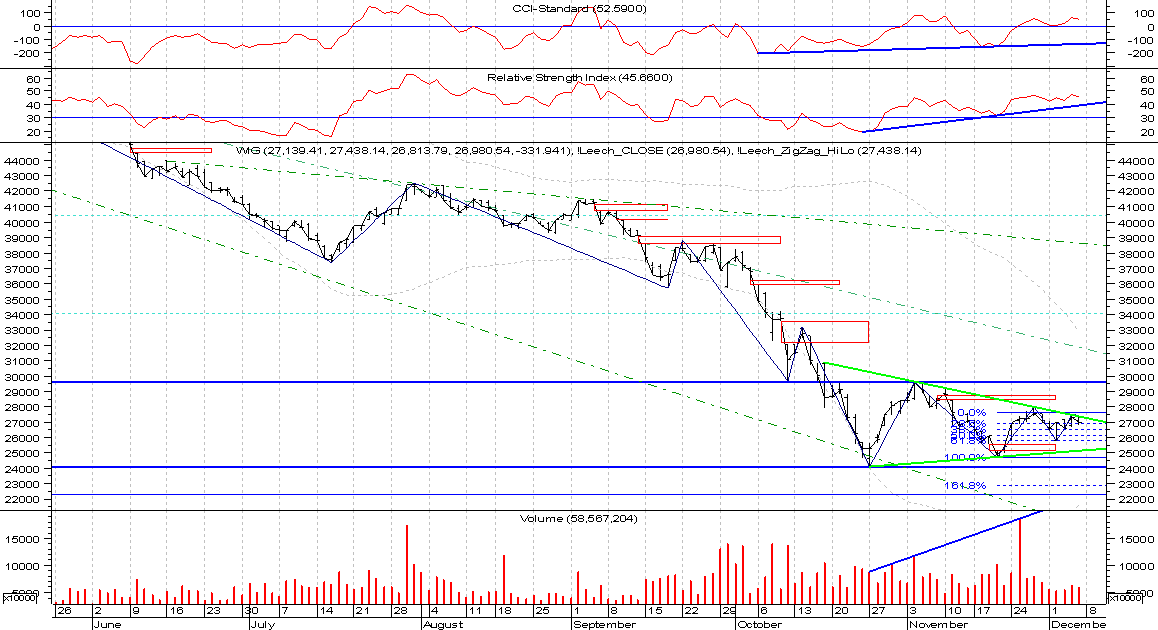

The intraday chart shows bounce:

The triangle concept has not been broken, but we still have no breakout either - therefore we shall treat this formation as a potential one only.

The triangle concept has not been broken, but we still have no breakout either - therefore we shall treat this formation as a potential one only.In medium and short-term we are still above last daily/intraday low, therefore the price is in uptrend. Also, the market shows some signs of strength: positive divergences in RSI and CCI, uptrend (or at least higher high) in few blue chip corporations (i.e.: BRE Bank SA, PBG SA, PGNIG). Nevertheless, long-term situation (weekly chart) has not been changed and the odds are in downtrend continuation (as per long-term signal).

Brian Shannon is quite optimistic in his daily video (here).

Deutsche Bank published an interesting paper on bonds - for quick summarization check SeekingAlpha portal (here).

The unemployment in US continues to grow (here).

Sources:

[http://seekingalpha.com/article/109401-review-of-100-years-of-corporate-bond-returns-revisited]

[http://blogs.wsj.com/economics/2008/12/05/jobs-report-how-much-worse-can-it-get]

No comments:

Post a Comment