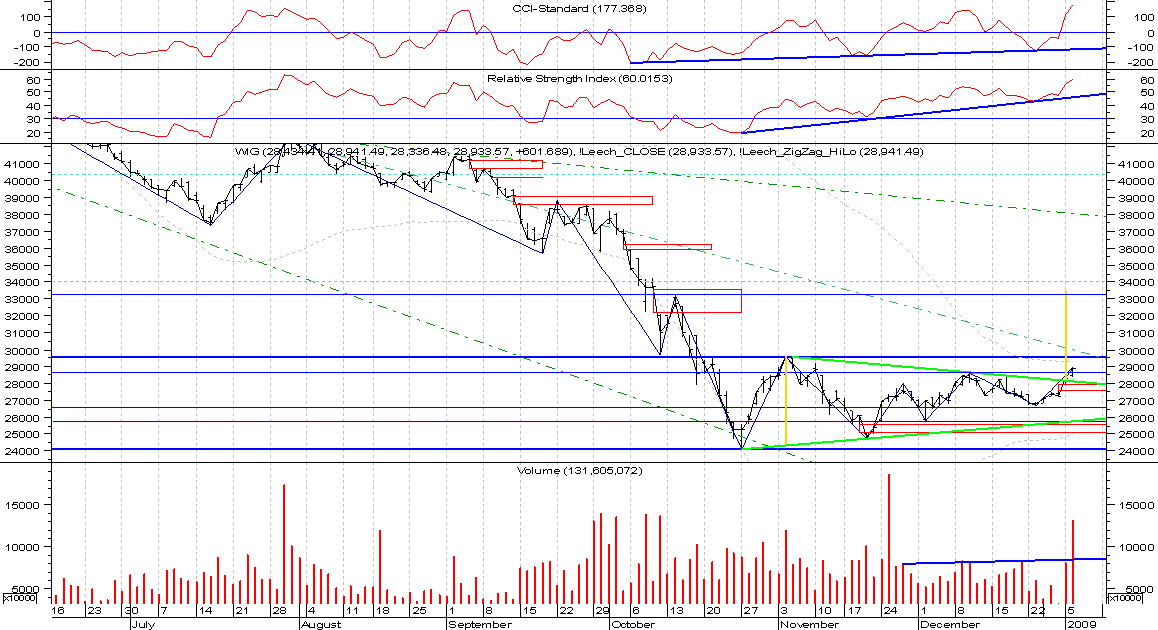

The WIG Index has broken the level of 28600 - weekly high from 10th Dec 2008. That generates another buy signal on long-term. However, the real test will be the level of 29600 (we are quite near it).

The WIG Index has broken the level of 28600 - weekly high from 10th Dec 2008. That generates another buy signal on long-term. However, the real test will be the level of 29600 (we are quite near it).Of course, it too early to call the bottom now and we won't know it was the bottom before we take the last market cycle high. But strong bullish sentiment is something we can use:

- daily uptrend (HH & HL pattern)

- broken trendline (with high volume)

- last weekly high (28600) taken

- CCI, RSI in uptrend

I'm personally waiting for strong and clear breakout of 29600.We don't know if bear market is over yet and if we can expect even more volatility. As per Elliott Wave Theory first wave is usually mostly retraced by second wave.

Therefore, I believe money management is very important and portfolio heat should be kept low now. Let's stay with small bets and restrictive stop-loss orders as for now.

Brett Steenbarger remains positive (here).

Sources:

[http://www.commodity-trading-solutions.com/portfolio-heat.html]

No comments:

Post a Comment