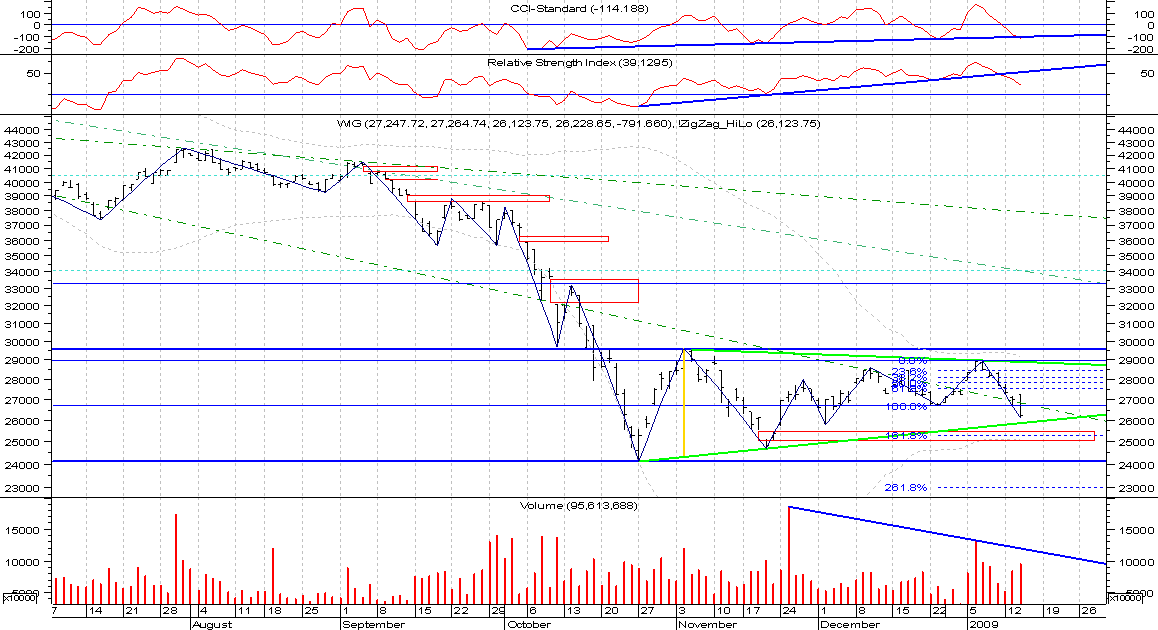

That generates sell signal in long-term, also confirmed by RSI and volume. Nevertheless, we are still within 24100 - 29600 area and it's better not to make any bets before we get out from those levels.

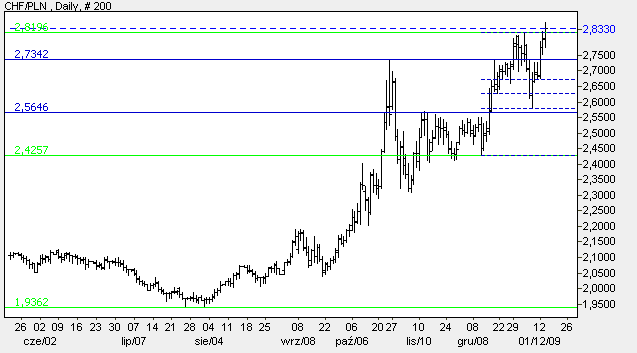

The CHFPLN today has broken its high (2.82) and that generates long-term buy signal (chart thanks to ChartStation):

That is not pleasant situation for polish mortgage owners.

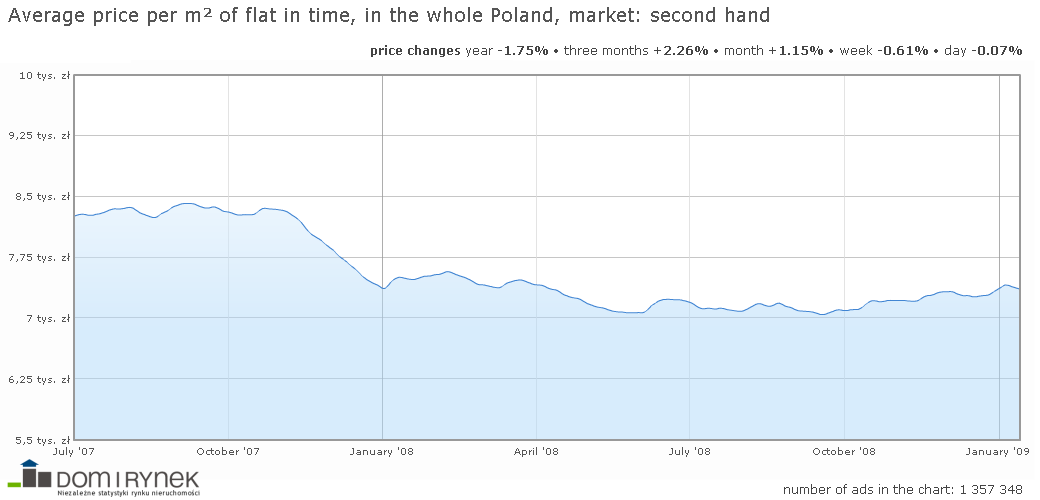

The polish property market is in interesting stage. Let's take a look at polish property prices (charts thanks to DomiRynek portal):

We are more interested in second hand prices as offers from developers are focusing on not-yet-built houses. We can note a huge drop (from ca.8350 PLN to ca.7500 PLN per square meter, makes ca.11% drop) in Q3 2007. Nevertheless, since then there was no big differences on yearly basics. We can also see the charts filtered for Warszawa's, Krakow's or Wroclaw's offers, but there is nothing like the huge price drops in US or UK.

Of course, the developers are adding more value for the price (like a finished flat, car garage, etc.), however the most of transactions are done in second hand market. Also, there is an interesting report for December 2008 (here via Google Language Tools).

Sources:

[http://www.domirynek.pl/chart/time_avgprice/flat/-/-/-/fsthand/-/]

[http://www.domirynek.pl/chart/time_avgprice/flat/-/-/-/sndhand/-/]

[http://inwestycje.pl/nieruchomosci/raporty_nieruchomosci/raport_rynku_mieszkaniowego___grudzien_2008;46946;0.html (via Google Language Tools)]

No comments:

Post a Comment