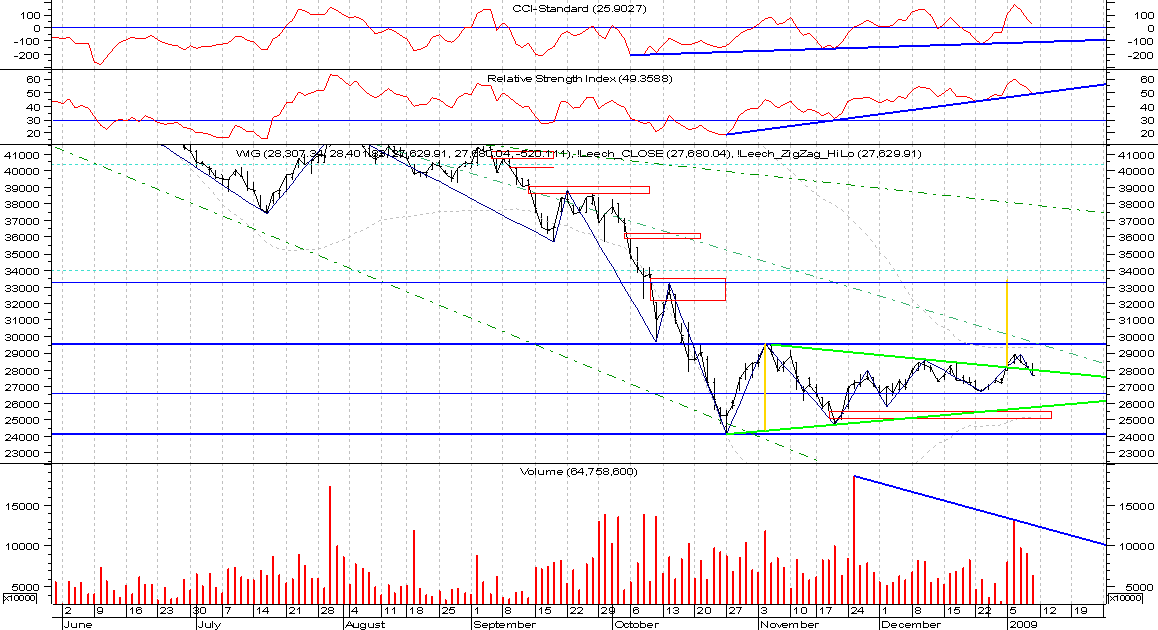

The preferable scenario from yesterday's post failed and the market is now below the trendline (ca.350 points). Nevertheless, the market stills look quite optimistic in medium- and long-term - as least unless the low from 23rd Dec (26700) is broken.

Open Finace published quite interesting rating of selected polish investment funds (here). We should note exceptional returns from bond funds. As per Market Cycle theory (this post) after rally in bonds comes rally in stocks.

The session in US was quite rough, as pointed by Brian Shannon in his video.

Smith Barney, Citigroup Inc.'s brokerage unit, might form joint venture with Morgan Stanley (here).

It seems some fund managers are saving their cash and waiting for the end of bear market (here).

US unemployment levels hit their record high (524 thousands) since Second World War (here).

Sources:

[http://www.marketwatch.com/news/story/Citi-talks-sell-brokerage-business/story.aspx?guid={7C719005-0F86-4991-91AD-C0767906F5E1}]

[http://www.marketwatch.com/news/story/For-some-stock-fund-managers/story.aspx?guid={A3199816-B1A9-4A7B-8816-9A3F0120B7E9}]

[http://gielda.onet.pl/0,1894402,wiadomosci.html (via Google Language Tools)]

[http://www.money.pl/gielda/wiadomosci/artykul/usa;najwiekszy;wzrost;bezrobocia;od;34;lat,191,0,413887.html (via Google Language Tools)]

No comments:

Post a Comment