CHFPLN has similar situation (buy signal generated after taking the high of 2.8196):

As for now, both uptrends stay intact and there is nothing suggesting trend reversals.

There are good news for polish mortgages - banks will be forced to accept payments in credit's currency, therefore the spreads will have to be more competitive.

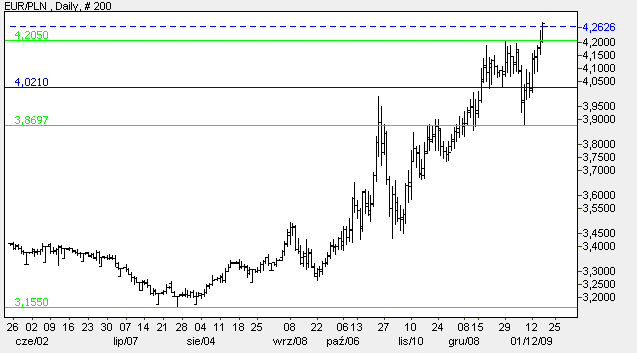

EUR/PLN

ReplyDeleteI do not believe that the current situation is a good buy from a timing perspective. I think the party is almost done! Please have a look to the monthly and to the weekly longterm chart starting from 2005 on. It might be shown soon as a false break, because the rallye is gone to fast. There is a long term resistance present, now. Perhaps the rallye goes on for a while, but I would be very careful in this situation for a buy. In my opinion your chart does not show the overall longterm situation. By the way in almost all timeframes the value is at the upper bollinger band.

My opinion and feedback, only

StaTrader

I hope you are right, also for CHFPLN - which is currently a disaster for polish mortgages.

ReplyDeleteI'm not plyaing FOREX, but IMHO breaking the high of 4.2050 is obviously a buy signal. My stoploss is on 3.86 and before that level it's still uptrend by definition.

Nevertheless, I'm not trying to time the market - it's more like pure trend following here. And there are few different opinions, like this one:

http://lemansa.files.wordpress.com/2009/01/eurpln.png

ok - I play Forex and I am a technical trader. So I am looking for a change for a view days only (swing down). That means the link you show above is not a discrepance to my trading style, because the retracement A->B on the right side of the chart is all I need to make money (EUR/PLN is then around 4.0). I have no idea what then follows it can be up it can be down.

ReplyDeleteIn principle I agree to your theory about the buy signal... In practice is is not so easy as you know, too.

StaTrader

As per EURPLN charts:

ReplyDeleteThis chart is for people who amassed or are earning EUR and want to convert it to PLN (mostly polish immigrants abroad). Thus, EURPLN and CHFPLN charts are reviewed weekly.

As for life-practice - most of those transfers are done via banks, thus huge spreads kill any reversal strategy (therefore - no buying EUR). During backtesting I did not find any better method for recognizing trend reversal (Fibo levels are often overrun, zigzag patterns like butterfly are not so reliable). Basically this system is working on weekly peaks.

As per CHFPLN charts:

Those charts are focused on forecasting the polish mortgages payments. 80% of polish mortgages were in CHF and right now only low CHF LIBOR shields the mortgage payments.

General idea is to forecast what we should expect in next month and maybe there more market timing will be useful.

Thank you for the information. The charts are very nice, but I cannot read polish. I am German. Have a nice week. My blog is: www.view.yourweb.de

ReplyDelete